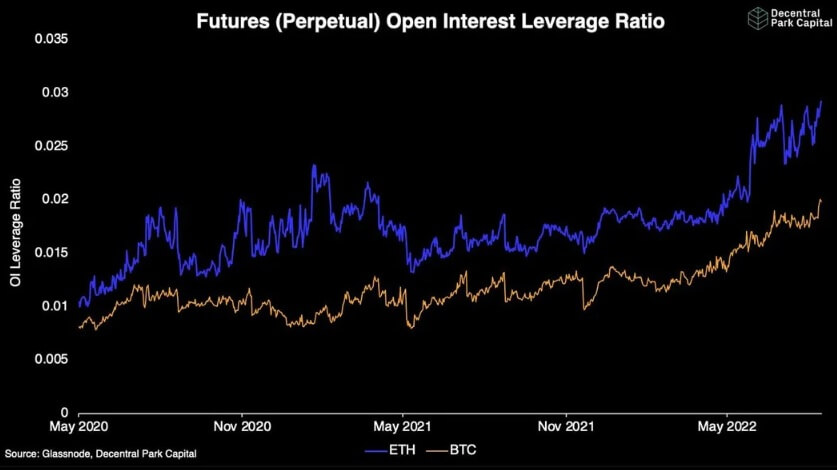

Ethereum (ETH) and Bitcoin (BTC) are at risk of big price moves. Analysts have noticed that there has been an increase in the leverage ratio of open futures contracts for both of these virtual currencies. Moreover, it remains at record high levels. Such a leap shows that interest in this type of financial ‘tools’ increases the risk of price volatility.

Ethereum and Bitcoin face volatility

Black clouds hung over the market of the two most popular virtual currencies. Analysts observing indices related to ETH and BTC futures are concerned about the liquidation cascade, which will translate into market volatility. The leverage ratio of open futures contracts on Ether and Bitcoin by Decentral Park Capital and Glassnode was taken under the microscope. In the case of both of these cryptocurrencies, this indicator remains at a record high.

Leverage ratio of open ETH and BTC futures. Source: Glassnode, Decentral Park Capital The above ratio is calculated by dividing the US dollar amount blocked in open perpetual contracts by the market capitalization of the underlying virtual currency. This measure shows the degree of financial leverage in relation to the market size or the sensitivity of the spot price to the activity of the derivatives market. In the present case, an increase in the index signals that the interest in open ETH and BTC contracts is higher than the market size, and at the same time creates a risk of increased price volatility. An investor who uses leverage in the futures market to take a short or long position places a margin and the exchange provides him with the rest of the value of the transaction. Traders, in turn, are at risk of liquidation, often caused by the rate moving in the opposite direction than expected. Forces to close short and long positions put pressure on the price of the asset, leading to greater volatility. The related risk increases with the higher the degree of financial leverage in relation to the size of the market.

Leverage ratio of open ETH and BTC futures. Source: Glassnode, Decentral Park Capital The above ratio is calculated by dividing the US dollar amount blocked in open perpetual contracts by the market capitalization of the underlying virtual currency. This measure shows the degree of financial leverage in relation to the market size or the sensitivity of the spot price to the activity of the derivatives market. In the present case, an increase in the index signals that the interest in open ETH and BTC contracts is higher than the market size, and at the same time creates a risk of increased price volatility. An investor who uses leverage in the futures market to take a short or long position places a margin and the exchange provides him with the rest of the value of the transaction. Traders, in turn, are at risk of liquidation, often caused by the rate moving in the opposite direction than expected. Forces to close short and long positions put pressure on the price of the asset, leading to greater volatility. The related risk increases with the higher the degree of financial leverage in relation to the size of the market.

Trade cryptocurrency CFDs with Capital.com. Get access to thousands of markets around the world

START INVESTING

ETH may experience greater ‘turbulence’ than BTC

A cryptocurrency belonging to the Ethereum project may experience more volatility on its chart than Bitcoin. This is indicated by the higher ETH leverage ratio. Another reason for the intense price movements may also be the upcoming September update of The Merge. Recently, it has been observed that the number of ETH coins leaving exchanges has dropped to levels close to zero, while for BTC it has been the other way around. Investors usually transfer their crypto assets to external crypto addresses when they want to HODL them. Transferring coins to trading platforms may in turn mean that you are going to sell them. Currently, the largest cryptocurrency trades around 20.2 thousand. hole. for a coin. In the daily range, it experienced a slight price change. Following her, Ether also did not notice any significant movements at the same time. Currently, its price fluctuates around 1.5 thousand. hole.

The author also recommends:

Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>