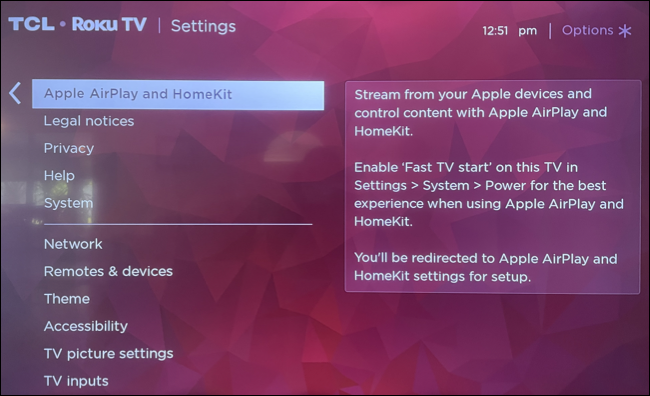

Euro to dollar exchange rate (EUR / USD) so far on Tuesday the current session time is below the parity level, and shortly after 14:00 at $ 0.992. Experts from MUFG and Goldman Sachs expect a further EUR / USD discount.

EUR / USD under $ 1.00 on Tuesday

According to ING, the energy crisis and the impending recession in the Eurozone mean that it is too early to expect a lasting EUR / USD rebound above $ 1.00. this year. – We think the dollar will remain strong throughout the year as restrictive policy slows economies and hits asset prices. – experts from ING pointed out. The ECB will make a monetary decision on Thursday. Forecasters argue about its level, whether it will be 50 bp or 25 bp. – As for the Fed, we expect a hike of 75 bp in September, 50 bp in November and 25 bp in December, said ING analysts. – In the case of the ECB it is only 50 bp in September and 25 bp in October.

Also check: The forecast of the euro (EUR / PLN) rate from ING assumes PLN 4.64 in 12 months

Goldman Sachs revised forecasts of the euro exchange rate (EUR / USD) downwards

Experts at Goldman Sachs warn of an impending major energy crisis in Europe this winter. While the euro area has made great strides in stockpiling gas for the coming winter, it has come at the cost of severely damaging demand through production cuts and does not entirely eliminate the risk of a more severe disruption in the winter. Goldman Sachs analysts said.

– We are pushing our EUR / USD forecast to 0.97, 0.97 and 1.05 over 3, 6 and 12 months (from 0.99, 1.02 and 1.15 previously) – they added. While there is still considerable uncertainty about the medium to long term outlook, we believe the situation warrants a more cautious base outlook and thus an even more sustained dollar appreciation.

You can trade Forex with the Plus500 broker, among others. Create an account and start trading.I WANT TO TRADE FOREX 77% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

The ECB has limited the depreciation of the euro, the MUFG believes

The depreciation of the euro was limited by hawkish rhetoric from the ECB in August, as noted by analysts of the investment bank MUFG. Now, they do not rule out another unexpected move and a hike of even 75 bp at the Thursday meeting. – Comments of ECB officials that a rate hike by 75 bp should be discussed at the September meeting, suggest that this bigger rate hike may be realized. – experts from the MUFG commented. At least six members of the ECB Governing Council indicated possible support for a larger rate hike in September.

EUR / USD exchange rate. Source: tradingview.com – In the near future, the direction of the euro exchange rate will depend as much on the price movements in wholesale natural gas prices as on the scale of possible government support to lower electricity prices. – they added. – We assume some downward revision of natural gas prices as demand declines and storage targets are met. – However, the Fed will be aggressive and the tightening of financial conditions will cause the EUR / USD to be traded at or below parity by the end of the year. – concluded the MUFG analysts.

EUR / USD exchange rate. Source: tradingview.com – In the near future, the direction of the euro exchange rate will depend as much on the price movements in wholesale natural gas prices as on the scale of possible government support to lower electricity prices. – they added. – We assume some downward revision of natural gas prices as demand declines and storage targets are met. – However, the Fed will be aggressive and the tightening of financial conditions will cause the EUR / USD to be traded at or below parity by the end of the year. – concluded the MUFG analysts.

The author also recommends:

See other phrases most searched for today: dollar exchange rate forum | ccc stocks buy | dax quotation | eurocash course | New Zealand dollar PLN | cargo pkp stock price | Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>