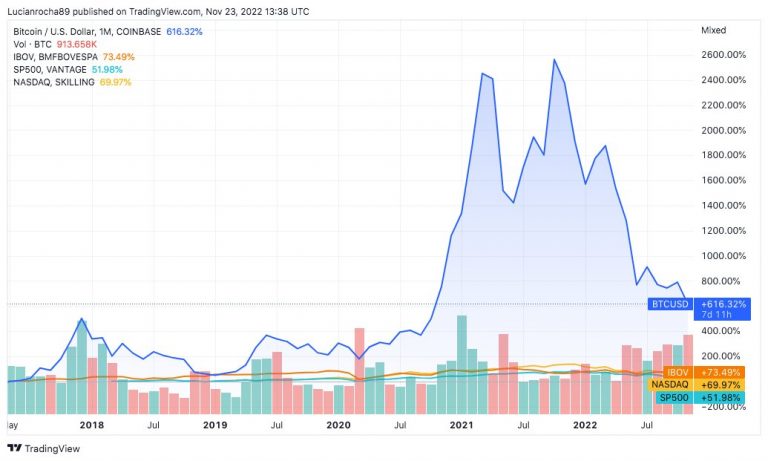

A tendency of most Wall Street and Faria Lima analysts is to criticize short-term Bitcoin (BTC) devaluations, especially in times of bear market. It is at this time that phrases like “Bitcoin is over” gain repercussions on social networks, especially on Twitter. Ironically, such analysts only pick the dates that suit them for criticism. That is, they analyze the price of BTC in a very short term window in which the chart proves them right. And yes, in fact the price of BTC has accumulated an appreciation of more than 70% in the last 12 months alone. However, on a medium-term time horizon, cryptocurrency is still the best investment on the market. In this sense, BTC has accumulated an appreciation of more than 600% since 2017, far surpassing the stock indices most indicated by its detractors.

“Bitcoin is gone”

Recently, analyst and founder of Suno Research Tiago Reis returned to talk about the moment of BTC’s fall. First, in response to a tweet Written by investor and economist Charles Mendlowicz, Reis stated, “Bitcoin is over.”

Source: Tiago Reis/Twitter. Then Suno’s founder himself wrote a tweet where he mocked the devaluation of the cryptocurrency. “Bitcoin is the only investment that people lose 80% and still applaud. This is called Stockholm syndrome,” she said.

Source: Tiago Reis/Twitter. However, there is an error and a half-truth in Reis’ two messages. The error, naturally, is in the first tweet, as BTC is not over. On the contrary, the network remains active, transferring value and with ever more computational power. Recently, the BTC hash rate reached 249 exahashes per second (EH/s) and broke a new record. That is, the network continues to grow stronger and far from ending.

Exponential losses or gains?

The half-truth lies in the fact that “Bitcoin investors lost 80%. Yes, this is true for anyone entering November 2021, when the cryptocurrency peaked in its price. Those who did this probably had a strong loss, especially if they sold at the lows of 2022. However, this analysis discards a factor that Reis himself has a lot of appreciation for in his work: the long term. And in the medium/long term, BTC outperforms any traditional market asset. In another tweet, Reis himself shared the profitability of the portfolio of assets recommended by Suno since its inception. The portfolio, which dates from April 2017 according to the photo published by the analyst, registered a 523% appreciation until the month of May 2022. Meanwhile, BTC registered a 617% increase, surpassing the assets indicated by Suno – that actually perform above the market average. Already compared to stock indices, BTC wins the Ibovespa, Nasdaq 100 and even the mighty S&P 500.

BTC appreciation compared to stock indices. Source: TradingView. It should be noted that this appreciation concerns only the price itself and does not take into account any distributions of dividends made by the shares. After all, as BTC has no cash flow, it would not make sense to include this data in the analysis. Therefore, even though the year 2022 is already in history as one of the most difficult for cryptocurrencies, history shows that the tendency of the class is to recover in the long term. Past profitability is no guarantee of future profitability, but long-term history counts in favor of BTC.