A cryptocurrency brokerage went through an unusual situation, when proving its reserves while withdrawals are blocked for customers. With the situation, many complained that there is no point in showing possessions, since the company’s liabilities are not clear. One of the largest in India, the platform has struggled to prove its reserves since the demise of FTX – a brokerage that said in one day that everything was fine, but stopped withdrawals in less than 24 hours, filing for bankruptcy 4 days later. With the case highlighted as a pain in the market, customers rush to withdraw values from brokerages.

Broker discloses proof of reservations, but blocks withdrawals and asks customers to calm down

In a publication aimed at showing transparency, the CEO of CoinDCX, Sumit Gupta, disclosed the alleged reserves of its platform. With the material produced in partnership with Nansen, a list of the brokerage’s onchain and offchain funds was disclosed. The executive said that the launch is just the first step, which will be complemented by an audit of internationally renowned companies.

“So, as promised, we are publicly releasing our Proof of Reserves. Our on-chain and off-chain assets with a full list of wallet addresses are now open to all and can be verified at the click of a button.”

In all, the exchange has $125 million worth of cryptocurrencies, of which Bitcoin (13.42%), Ethereum (12.52%) and Shiba Inu (11.32%) are the most. The problem is that since June the brokerage has been prohibited from releasing withdrawals to customers, as well as accepting deposits. That is, proof of reservations does not change much at the moment, since the platform is suspended. For customers who complain about the lack of withdrawals and ask for guarantees, CoinDCX support asks for calm in the face of the situation.

“We never wanted our users to experience such inconveniences. Please be assured that we are working with the relevant authorities to gain regulatory clarity to allow crypto transfers in the most compliant manner to resume service as soon as possible. We ask for your patience and understanding in this regard. “

We request your patience and understanding in this regard. (2/2) — CoinDCX Cares (@CoinDCX_Cares) November 24, 2022

Quality of proof of bookings matters

What does the case reveal to the market? It is no use for cryptocurrency brokers to present alleged “proofs of reserves”, since they do not have qualities and support regarding the data presented. A good practice for company management involves not operating with customers’ cryptocurrencies. Thus, even after proving that there are reservations, platforms must prove that customers are protected. In addition, brokerage firms’ liabilities are as important as assets, as they would ensure an adequate balance sheet. The CEO of CoinDCX himself has stated that he will have to provide more evidence to convince his clients.

“In my opinion, the much-advocated ‘Proof of Reserves’ provides a stand-alone asset value, it only shows one side of the play. There is no visibility of liabilities. Proof of Reserves without Proof of Liabilities is only half the picture. So let’s take one step forward.”

In my opinion, the much advocated “Proof of reserves” provides a standalone asset value, it only showcases one side of the part. There’s no visibility of liabilities. Proof of booking without Proof of liability is only half the picture.

So let’s take it one step ahead and — Sumit Gupta (CoinDCX) (@smtgpt) November 13, 2022

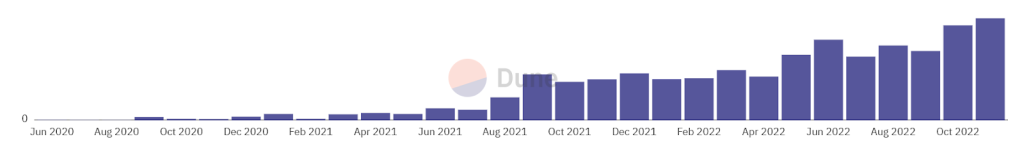

In any case, the collapse of the cryptocurrency market in 2022 was caused by the extreme leverage of companies in the sector. With the fall, the future of companies will then be guided by transparency, increasingly demanded by traders.