The Babylon Finance protocol, focused on making loans with cryptocurrencies, announced the end of its activities on Thursday (1). Who released the information was Ramon Recuero, founder of the protocol. According to the executive, two reasons led Babylon to close down its activities. The first was the consequences of a hacker attack that hit the protocol in April. As a result of the invasion, Babylon lost around BRL 3 million, or BRL 15.7 million at current prices. The bearish season in the cryptocurrency market also played a role, affecting the liquidity of several protocols. These effects also affected Babylon, which chose to end its activities in a controlled manner.

Babylon lost 86% of allocated amount

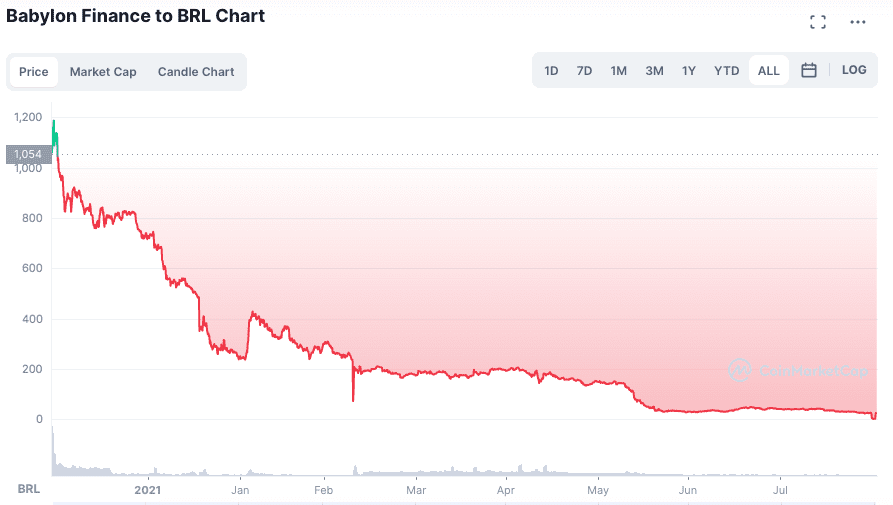

Ramon Recuero, founder of Babylon Finance, shared the decision on Twitter. According to the software engineer and founder of the application, Babylon should gradually cease its activities. The protocol is expected to come to an end in November this year. “Despite our efforts, we have not been able to reverse the negative momentum caused by the attack on Rari,” said Recuero. Another issue is that Babylon lost 86% of its Total Locked Value (TVL). That is, the protocol had US$ 30 million (R$ 157 million), but it dropped to just US$ 4 million (R$ 21 million). Interestingly, the protocol’s native token (BABL) recorded a significant appreciation of 1,033% in the last 24 hours, going from BRL 2.30 to BRL 26.61. However, the token has collapsed in the long term, as without a price it reached a high of BRL 1,180 in November 2021.

BABL token collapsed in less than a year. Source: CoinMarketCap.

Pre-closing measures

In a Medium article, Recuero noted some actions the Babylon team will take ahead of the eventual closure. At first, the team will distribute all the leftovers from their treasury to BABL and hBABL holders, probably as a way to make up for the losses. This distribution process will begin next Tuesday (6). In addition, investors will get all of their tokens back – a decision that may have influenced BABL’s strong appreciation. Next, the team will also withdraw all remaining liquidity from the tokens from the decentralized exchange Uniswap. Finally, the team gave all strategists a deadline of November 15th to close their strategies. According to the article, the Babylon website and Discord channel will be closed on that day.

Attack that affected protocol

As explained by Recuero, the main factor that led to Babylon’s closure was the hacker attack suffered by Rari Capital. This attack took place on April 20 and resulted in the loss of US$ 80 million, about R$ 400 million at the price at the time. Unfortunately, Babylon Finance had several assets worth up to $30 million in Rari Capital. As a result, the theft greatly affected the protocol’s reserves. Following the attack, Babylon Finance clients made a mass withdrawal of their assets from the protocol. The resulting panic caused the BABL token to lose more than 70% of its value and collapse. Efforts to contain the situation proved futile and Babylon was unable to regain liquidity. The difficult decision to shut down the platform was the team’s last resort. Read also: Robinhood will allow trading of Cardano (ADA) Read also: Crypto.com drops BRL 2.5 billion sponsorship deal with UEFA Champions League Read also: Fake Google Translate app installs cryptocurrency miner in more than 100 thousand computers