You’ve probably already caught yourself thinking about the future of your children or children who are close to you, such as nephews or cousins, and making investments for them right now is a great way to do something for their future. It is common for parents to worry about their children’s future, to think about how they will guarantee their children’s education and health, and saving money is essential to ensure that they will have a financial guarantee.

Financial clarification / Source: Revista Saber é Saúde As a form of financial planning, it is important that a child’s parents save money from an early age, the name is given as savings, which means saving an amount of money, in this case, for the their children and thinking about their future. Investing allows you to insert your children into a reality where they are taught financial education from an early age and this will make them adults with the knowledge and experience to make considerable decisions about finances and investments.

Table of Contents

start small

The idea of this investment is that it is long-term, to be more profitable and also that it is a type of investment that has less risk of losses, that is, starting with this thought is the most important.

Child controlling finances / Source: Ab Notícias News After choosing which investment, have on average how much you want to save for your child, and so you can get a sense of how much to apply. The amount of money allocated is subjective, it depends from family to family, mainly in terms of income for each one, but know that it is not necessary to start investing with a lot of money. The idea of investments is that you can do what you have now, earn more and not wait to have enough to earn, it is a way to create an opportunity for children or teenagers to understand the basics and decide later what they will do. This decision can be applied and invest that money even more, with the knowledge that is developed early on in it.

Type of investment

It is recommended to invest for a child or young person when the person responsible for the decisions and applications has a greater knowledge on the subject, so that the income that will be destined for the children is not put at greater risk.

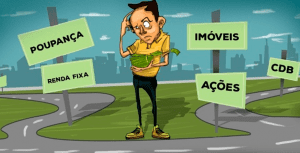

A parent who doesn’t know where to start investing for his child / Source: UOL Economia That’s why choosing where to invest is important, there are several types of investments, each one will have an affinity with their goals, see what the best choices are in this case:

Child Welfare

A child pension insurance is a good option for an investment modality, there is not much complexity in it, just choose a plan, pay for it and when your child grows up and becomes an adult, they will redeem their assets and use them the way they prefer. . It is made with monthly payments and the amount will depend on the company and the plan chosen, in general, child pension plans start from R$30.00, it is an affordable value that guarantees the stability of your child.

Direct Treasure

Treasury Direct is an investment platform in which National Treasury bonds are allocated, in which you invest safely and profitably, there are few risks, as they are government bonds. Basically you can choose different ways to be profitable with it, because you see, the metric used to know the amount you will get back is the selic rate, responsible for defining all interest rates referring to factors of the economy. You can choose to have your interest returned in relation to the Selic rate on the day of the contract, when the contract expires, or half referring to when you started the investment and the other half when the investment expires.

Direct Treasury Child Investor / Source: Depositphotos It is worth mentioning that when the Selic rate is high, interest rates are also high and when it drops, interest rates are low, this is an issue to be defined according to the objectives. If you want more security, do it with the pre-fixed rate, which you already know how much you will receive on the day you sign the contract, if you want more profitability, do the post-fixed rate, but if you want both, do the hybrid and take into account the destination of the money. You can decide how long you want to invest, but remember, the longer you invest, the more profitability.

Real Estate Funds

Through Real Estate Funds, you have greater security within the stock market, you can invest and have a return on properties that are not yours, but that remain in the market for the money you invest and then return with interest. This type of investment is riskier than the two above, however, doing it the right way, with the necessary knowledge, you can have more profitability, because also, the riskier an investment, the more profitable it is.

Person receiving dividend / Source: Rissardi Consultoria

Actions

Applying in stocks is also riskier, however the payments are monthly and through dividends, that is, you can have high yields and on a monthly basis. To choose the stock to invest in, it is important that you know the company, because then you will be able to get a sense of how the company works in terms of development, profit, billing, taxes and other important information that, if not correct, will put the investment your child at greater risk. Disclaimer: The text presented in this column does not necessarily reflect the opinion of CriptoFácil. Read also: 3D scanning and non-cryptocurrencies is the most important key to expanding the Metaverse Read also: ETF QDFI11 registers volume of R$ 9 million in its first week at B3 4 DeFi tokens with bullish signals