The events of the past week have been absolutely crippling for Bitcoin. The collapse of FTX stands as the most impactful insolvency of a company centralized in the crypto space since the demise of Mt Gox in 2014. For those unfortunate enough to have their funds held up in FTX, Mt Gox presents a sobering comparison – eight years after the exchange closed its doors, customers still haven’t seen a single penny. Bankruptcy proceedings are long, time-consuming, and will likely only end with clients getting pennies on the dollar, in any case. The reality of an $8 billion hole in FTX’s balance sheet isn’t going away anytime soon.

Cold storage is the only safe way

These events couldn’t be a better reminder of the dangers inherent in the cryptocurrency space. There are no ransoms in the crypto space. These are not banks, covered by insurance, mandatory reserves or other strict regulations. The reality is that it is nearly impossible to know what exchanges are doing with customer deposits. Until it’s too late – we’ll probably know very soon what exactly happened to all the funds trapped in the tangled web of Alameda and FTX. There is only one way for anyone to serve their crypto assets with 100% security and that is cold storage. Offline asset withdrawal means there is zero counterparty risk, with holders not needing to rely on any other individual, party or intermediary. It’s like putting gold bars under your mattress, in a way.

Funds leave exchanges for cold storage

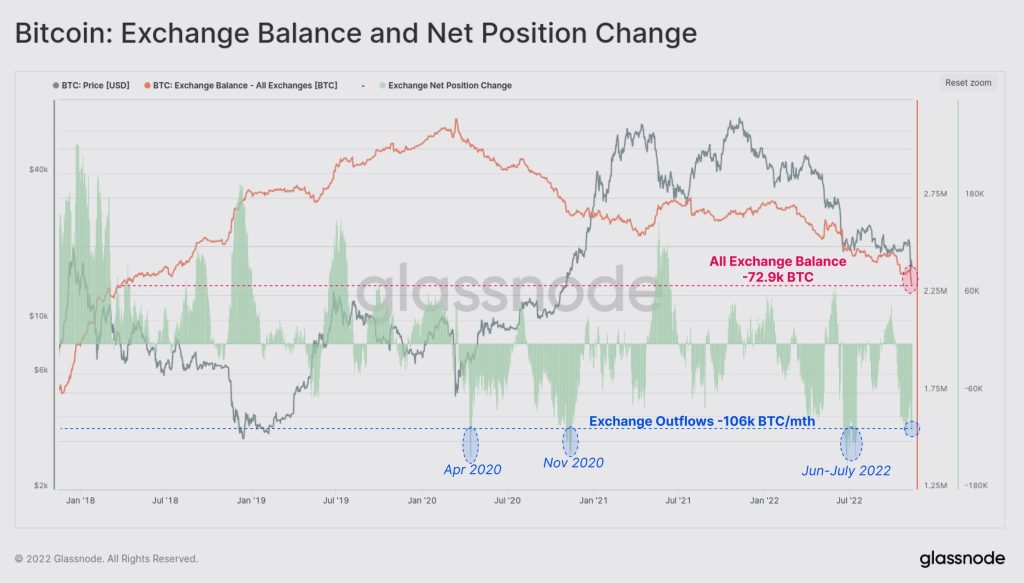

Look at data from on-chain analytics firm Glassnode, Bitcoin flows over the past week show just how much the market freaked out. People are finding out the hard way that cold storage is the only safe way to keep cryptocurrencies. In fact, exchanges just experienced one of the biggest weekly outflows in Bitcoin history, with nearly 73,000 bitcoins leaving exchanges.

This puts the week in the same moment of panic as March 2020, when the COVID pandemic hit us, as well as June and July of this year, when the market crashed in the wake of the Terra crisis, with all the companies involved in it. Looking at Ethereum, the pattern is similar:

Tether sold?

Another interesting factor to keep track of in these (unfortunately repeated) crises is Tether. The controversial stablecoin dropped as much as 95 cents after the Terra crisis, as people feared it didn’t have enough reserves to handle immense selling pressure, which saw its market plummet from $83 billion on the eve of the crash to $63 billion. one month later. This time, the reaction was more subdued – at least so far. Tether experienced selling, but not at the same level as in May, as its market cap dropped from $69.8 billion to $66.3 billion, down 5%. The peg failed to hold $1, but it didn’t come close to dropping to the 95 cents seen in May. This time it reached $0.986 – and even then, very briefly last Thursday. While he didn’t get his $1 back, it’s very close to just fractions of a penny. In conclusion, this crisis had an obvious effect on market sentiments. Notably, in the meantime, Binance CEO CZ was tweeting that anyone interested in security should simply turn to cold storage. It seems the market is listening. That and, well, selling. Both reactions are understandable, as the cryptocurrency reverberates from yet another crippling blow stemming from a centralized player employing poor risk management, naivety and reckless leverage – with customers again paying the price.