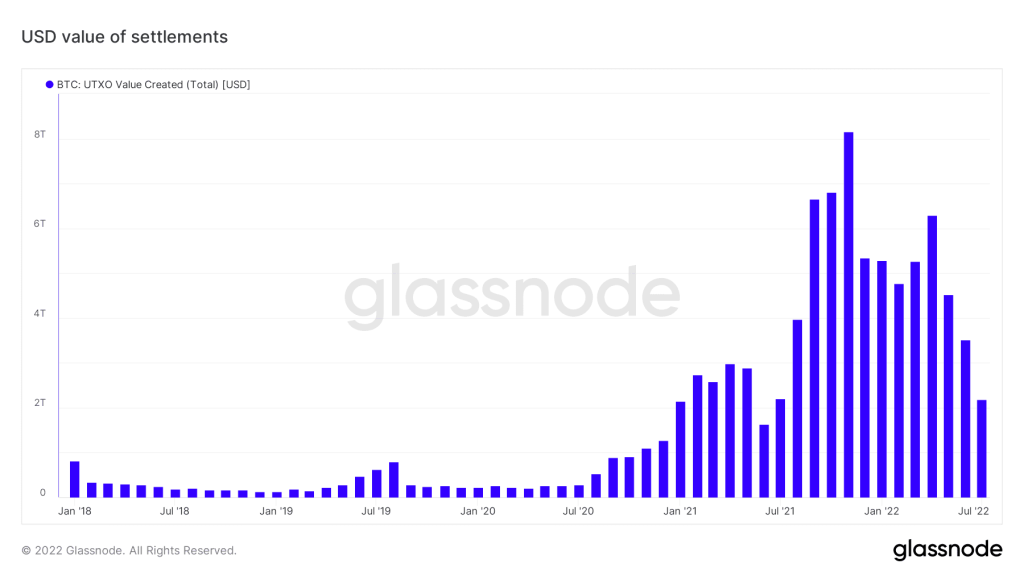

Even with the price falling, the main Bitcoin (BTC) network continued to record significant payment clearing volumes. According to Riot Blockchain analyst Pierre Rochard, the network processed $2 trillion in payments during the month of July. The value, which corresponds to around R$ 1 trillion at the current price, is not the highest in history. This record came in November 2021, when the network processed $8 trillion. This means all payments made through the blockchain, the so-called Layer 1 of BTC. But what is impressive is that in the last 12 months, Bitcoin has processed no less than $62 trillion (R$ 319 trillion) in payments in the last 12 months. The figure, which seems unimaginable, is the equivalent of almost three times the GDP of the United States (US$ 21 trillion), which is the largest economy in the world.

Amount of payments processed on the BTC blockchain in 12 months. Source: Pierre Rochard/Twitter. In other words, Bitcoin continues to consolidate itself as an efficient means of moving large amounts of money. Even with blockchain’s limitations in terms of capacity, the 12-month volume reinforces that the network can be used for large payments. In this sense, CriptoFácil spoke with Diego Kolling, creator of the Noderunners Brasil group and enthusiast of Bitcoin and the Lightning Network. And according to Kolling, the data released by Rochard bring surprising numbers.

Strengthening the main network

Firstly, the total volume of $62 trillion has completely passed through the first layer of BTC, without the use of Lightning or other layers. This is quite a feat, considering that the blockchain can process only seven transactions per second on average. In explaining the impact of this, Kolling makes a connection between the layers of BTC and the operations of the traditional banking system. In this example, Layer 1 functions like the operations between central banks and commercial banks, which coordinate the international payments system. As these operations move large amounts, they are carried out at Layer 1, which has more security and keeps the record of transactions. And the big increase in the total amount transacted shows the strength that BTC is gaining. “This is the most surprising thing: it was all on-chain. On-chain is like banking transactions between central banks, which coordinate these large international transactions. In this sense, on-chain operations are also similar to the daily interbank payments made by banks. And BTC Tier 1 is gaining liquidity in these market operations,” he explains. Layer 2, on the other hand, represents transactions between people, such as current accounts for everyday use. This is where, in the case of BTC, Lightning comes in, which has greater scalability especially for smaller payments.

Trillions without intermediaries

However, all these payments require the presence of intermediaries, when made through the traditional banking system. Currently, banks, payment providers and central banks perform this role, brokering the trillions of dollars moved daily. This, however, is not necessary for BTC, which is a peer-to-peer (P2P) network without any need for an intermediary. And for Kolling, the biggest surprise is precisely the expressive volume moved without this need. Therefore, the BTC network could play an important geopolitical role in the future. If processing capacity remains high, BTC can serve as a transaction tool free from the influence of governments. “This volume required no intermediaries and no one could have stopped the transactions. If Russia, for example, stocked its reserves in BTC instead of gold, the US would not be able to block this amount. After all, the US would not have the power to block BTC and its transactions,” explains Kolling. Therefore, BTC gaining more and more liquidity is an extremely positive thing for its mass use, generating confidence in the security of the network. Also Read: Strike Launches Debit Card For Bitcoin Payments Read Also: Binance Swap Farming Launches Giveaway With Over BRL 250,000 in Prizes Read Also: CRO Token Price Sees Bulls Using Their Last Ammo to Attack BRL 0.81