Every year, the Collins Dictionary selects ”the words that marked the year”. In 2021, the 10 champion terms were: non-fungible tokens (NFTs), climate anxiety, metaverse, cryptocurrencies, doubly vaccinated, pingdemia (pandemic notifications), cheugy (cheesy with cringe), hybrid work, new pronouns, and regencycore (clothes with royal style). In Cointelegraph’s annual selection of the cryptocurrency industry’s most influential people, terms and associations, the metaverse was ranked #25 and the Crypto Climate Accord and Climate Chain Coalition ranked #34, alongside NFT collector and rapper Snoop Dog. .

The overall relevance of the crypto sector in the year 2021 has been helped by venture capitalists, who have invested more than $25 billion in blockchain companies in the last year, tripling the investment made in 2020.

Source: Pitchbook

Table of Contents

Impact draws attention from funds that total US$ 45 trillion

According to Reuters, the year was for ESG (Environmental, Social and Governance), which reached a record $649 billion dollars in investments of funds focused on the climate transition only in the month of November. In 2021, venture investment in climate tech, which are technology startups focused on climate solutions, reached the US$29 billion mark for the first time. In the traditional investment sector, funds representing more than $45 trillion of assets under management have committed to transitioning their portfolios to low-carbon, climate-positive investments. Much of the advancement of the investment sector in companies and climate-related solutions comes from regulatory obligations and the increasingly clear realization that climate risk is the biggest challenge of our generation. But beyond the regulatory issue, the transformation of this paradigm is being catalyzed by the change in the calculation of consumers, who are willing to pay more for ethical and sustainable products. Added to regulatory obligations and consumer demands, we have the boom in the ESG sector. It doesn’t matter if you are a crypto native, a traditional investor looking to diversify into crypto or if your interest is in sustainable investments, NFTs, metaverses and cryptocurrencies will disrupt the ESG sector and cryptocurrencies need real cases to strengthen your ecosystem. While estimates expect cryptocurrencies to reach the $50 trillion mark in capitalization by 2030, global ESG investments are expected to reach $53 trillion by 2025, the impact on web3 is a trillion dollar encounter, which is just being born and we want to help you navigate this trend.

Elon Musk’s twitter and the issue of the environmental impact of cryptocurrencies

after the Elon Musk’s twitter on investor concerns over Bitcoin’s climate issue, which preceded a 50% asset price drop, the crypto sector turned to the climate issue and the debate widened, from Bitcoin’s energy expenditure to NFT’s carbon . But despite the growing number of exchanges that offset each other, miners that use renewable energy, and the recent explosion in the use of cryptocurrencies to support Ukraine, there are few solutions that seek to leverage decentralized technologies to actually solve global problems, rather than simply look at the issue from the perspective of mitigating its negative impacts.

Top Impact Tokens

But that will change. We are already seeing the signs and the industry is already counting on significant web3 projects – decentralized technologies such as DeFi, Decentralized Autonomous Organizations (DAOS) and the NFTs – for impact. Projects such as Stepn (GMT & GST), Regen Network (REGEN), KlimaDAO (KLIMA), Energy Web Token (EWT), Power Ledger (POWR) and Toucan Protocol (BTC) already amount to hundreds of millions in capitalization and more than 34 million tons of offset carbon. But it’s still not enough, blockchain’s potential for impact is about helping to solve the biggest problems we face as a society, from the erosion of socialization to global warming. One example we like is move-to-earn, from projects like GenoPets and Stepn. Obesity is one of the biggest problems in the world and kills more today than wars. What if, instead of technology and metaverses being used to increase alienation, they could be used to encourage physical exercise and people’s interaction outside the home? This is the purpose of move-to-earn, games that encourage users to move and reward them for this activity. Helping health and the environment.

Expanding perspectives: from carbon to habitats

However, one of the challenges we face when it comes to the web3 impact sector is the transposition of the assets and perspectives of the traditional market. As the Breakthrough Energy report shows, in a letter signed by Bill Gates, the offset mindset needs to be expanded, going beyond the current format of exclusively carbon-only credits. The same goes for the impact on the web3, the opportunities are immense, but the models continue to reproduce the carbon mindset. In the same way that the crypto sector looks to the climate problem from the perspective of mitigation, the traditional sector, which has been dealing with the issue for some decades, only sees carbon offsetting. Ignoring the fact that carbon stock is just one of dozens of ecosystem services linked to forests, the sea, swamps and other natural habitats.

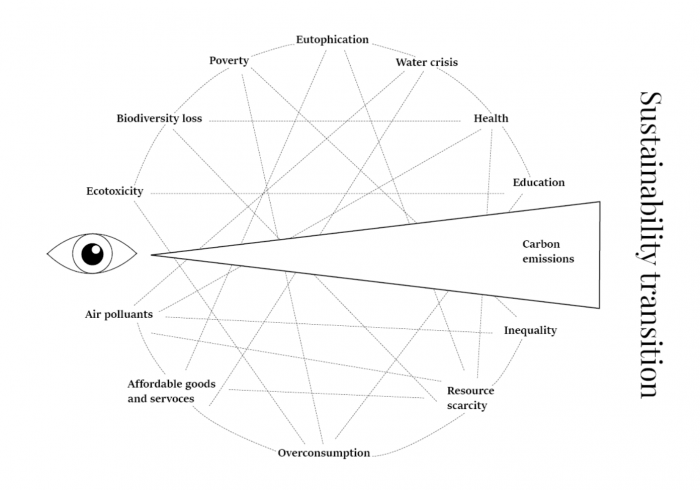

Source: art adapted by Impacta from the original by Jan Konietzko In the transition to a society aware of climate and social risks, innovation is a fundamental factor for creating markets and anti-fragile, long-term and comprehensive solutions. As mentioned in Bill Gates’ letter, “Even if all the offsets worked exactly as advertised, they would do little to encourage the innovation we need for a global energy transition.” This is the case of projects that bet on the transition to a sustainable and regenerative economy, where negative externalities are transformed into positive externalities. Not just offsetting carbon emissions, but creating purposeful solutions to global problems.

Decentralized insurance to strengthen agricultural systems

An interesting case of transformation triggered by climate change is the insurance sector – a $40 trillion market – which is rapidly transforming. As floods, hurricanes, wildfires and other events destroy cities, the insurance industry is affected and needs to raise its prices, excluding even more at-risk populations from accessing these services. In Sub-Saharan Africa – despite a five-fold increase in agricultural microinsurance recorded between 2011 and 2014 – only 3% of smallholders have agricultural insurance. The exclusion of these farmers worsens the food crisis, aggravating the cycle of negative impacts. The big question here is, how to think about decentralized insurance solutions to protect these populations and for the resilience of agricultural systems? An interesting example is Etherisc, a protocol that is proposing to create decentralized insurance solutions for farmers. How can we overcome the constrained mindset, which approaches the environmental problem at the enterprise level as a constrained carbon offset problem – ignoring all other strands of the problem and all the unimaginable solutions that can emerge from developing web3 solutions focused on global problems?

Impact Series

To answer this question, the blockchain series for positive impact, in partnership with the Celo Foundation and Criptofácil, will address the biggest challenges and the most innovative solutions of impact on web3, unfolding its podcast series into eight articles (with this one) published weekly. here at Cryptoeasy. The articles will cover: #2 Environmental Crypto Assets: We will explain how cryptocurrencies are helping to digitize environmental ecosystem services, as well as data from the growing regenerative finance sector. #3 Digital infrastructure: how technological solutions are providing the basic infrastructure for the real implementation of cases for the common good. #4 Smart and green cities: we will focus here on resource management, and on the use of blockchain technology to improve the population’s quality of life. #5 Financial inclusion: how are cryptocurrencies and the infrastructure of decentralized protocols helping the banking of those who have never had access to financial products? #6 Circular economy and regenerative finance: How can blockchain technology help us solve global problems such as waste management, encouraging environmental behavior and promoting positive externalities? #7 DAOs and Digital Governance: How Online and Offline Communities Find New, More Inclusive Organizational Formats and Decentralized Structure in Blockchain Technology. #8 Challenges and summary of projects and perspectives presented.

Developing the ground for impact: Celo

The innovation ecosystem requires access to seed capital and technical support for the first steps of a new business. Without experimentation, it is impossible to develop innovative technological solutions with great potential for positive impact. Celo’s ecosystem provides tools for entrepreneurs interested in creating their projects: Grants, Celo Camp and Flori are some examples. Each of them has its specificities and helps entrepreneurs with a phase of their development. Celo Grants – which makes the Impact podcast possible – is an open program that supports projects that share Celo’s mission. Entrepreneurs seeking guidance and capital at different stages of development can submit their proposals to create, develop and launch their products. Celo Camp is a program focused on providing the necessary support for developers and creators who want to create and build new products and seek support with mentors. Camp registration is open until March 22. For projects that have already gone through the ideation and creation phase and are looking to expand their operations, Flori is there. Flori is a fund designed to assist in the scalability of projects, providing both capital and networking with investors and entrepreneurs in the sector. Interested in knowing more? Take a look at the companies that have already been accelerated by the program: .floriventures.com/community Warning: The text presented in this column does not necessarily reflect the opinion of CriptoFácil. Read also: NEOS Newsletter: Instagram starts exploring NFTs on its platform Read also: Understand why the biggest crypto thefts are in bridges Read also: TradingView Column: Cryptocurrency market still tense, analysts waiting for recovery