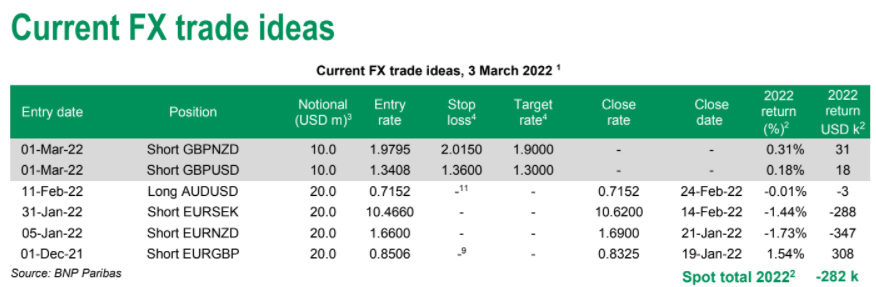

In a currency report dated March 3, 2022, BNP Paribas analysts announced that they had opened short positions in the pound sterling with a total value of $ 10 million. They expect the pound to lose against both the New Zealand dollar (GBP / NZD) and the US dollar (GBP / USD).

The GBP / USD currency pair, according to BNP Paribas, is to drop to 1.30, while GBP / NZD will drop to 1.90

The British currency has been under stronger pressure since the end of February and is currently testing the lowest levels since last December

However, the pound is not weak in relation to all competitors: it is gaining strongly to the weaker zloty, testing the level of PLN 5.90 on Friday.

More similar and interesting articles can be found on the Comparic.pl home page

The pound was down. BNP Paribas opens new short positions on GBP / USD and GBP / NZD

According to BNP Paribas analysts, the plunges of the British currency that started at the end of February will continue. Consequently, they decided to open two new positions in their currency portfolio which were activated on March 1. The short GBP / NZD was activated at 1.9795 and is targeting 1.90. The stop loss is at 2.0150. So far, the currency pair is clearly moving towards its target, currently already trading at 1.9365.

Levels of BNP Paribas short position on GBP / NZD As you can see in the chart below, the pound has already lost 2.2% against the New Zealand dollar since the activation of the position (falling by over 430 pips). At this point, only half of the range is left to execute. A second short position, GBP / USD, also opened on March 1 at 1.3408. The hedging order is set to 1.3600 and the target is 1.3000. Here, too, the value of the position is 10 million, i.e. BNP staked a total of $ 20 million on the losses of the pound.

Levels of BNP Paribas short position on GBP / NZD As you can see in the chart below, the pound has already lost 2.2% against the New Zealand dollar since the activation of the position (falling by over 430 pips). At this point, only half of the range is left to execute. A second short position, GBP / USD, also opened on March 1 at 1.3408. The hedging order is set to 1.3600 and the target is 1.3000. Here, too, the value of the position is 10 million, i.e. BNP staked a total of $ 20 million on the losses of the pound.

BNP Paribas Short Levels on GBP / USD From its opening on March 1 until the end of the week, the pound loses 1.5% (200 pips) to the US Dollar. He needs another 200 points to take a short position. Although the bank did not provide an additional comment to the position information, another large trading institution, Westpac, also has a similar view on the pound rate. According to his economists, GB / USD will test the March lows, going down to $ 1.3165. – The MPC debate is likely to increase as fighting inflation with higher rates is likely to increase the cost of living for households and businesses. GBP / USD may break the support and risk of a re-test of the lows from December 2021 in the range of 1.3165-1.3175 – commented Westpac analysts.

BNP Paribas Short Levels on GBP / USD From its opening on March 1 until the end of the week, the pound loses 1.5% (200 pips) to the US Dollar. He needs another 200 points to take a short position. Although the bank did not provide an additional comment to the position information, another large trading institution, Westpac, also has a similar view on the pound rate. According to his economists, GB / USD will test the March lows, going down to $ 1.3165. – The MPC debate is likely to increase as fighting inflation with higher rates is likely to increase the cost of living for households and businesses. GBP / USD may break the support and risk of a re-test of the lows from December 2021 in the range of 1.3165-1.3175 – commented Westpac analysts.

The team of Conotoxia Ltd. analysts prepared for you the report “Raw materials in times of conflict”. How will gold, oil and gas behave?

GET A FREE REPORT CONOTOXIA LTD.

Poor beginnings of the BNP Paribas currency portfolio in 2022

So far, the BNP team has not had any successful Forex positions in the current year. From the beginning, he closed four, of which only one brought a profit. It was a short on EUR / GBP. The next three, however, are losses (significant in two cases), and the portfolio’s total balance as at March 3 was -282 thousand dollars.

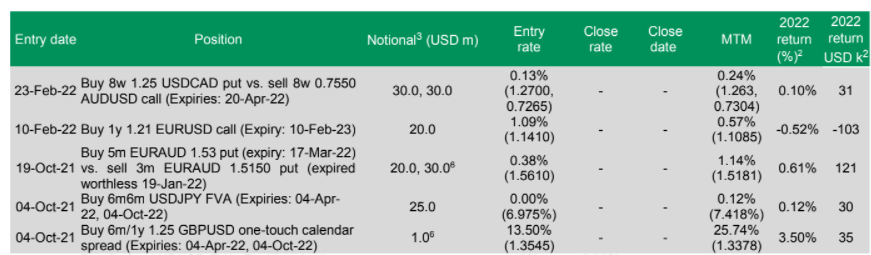

Source: BNP Paribas BNP currently also maintains five open options, of which the two most recent were added in February. Their list is below:

Source: BNP Paribas BNP currently also maintains five open options, of which the two most recent were added in February. Their list is below:

Source: BNP Paribas

Source: BNP Paribas

The author also recommends:

Follow us on Google News. Search what is important and stay up to date with the market! Watch us >>