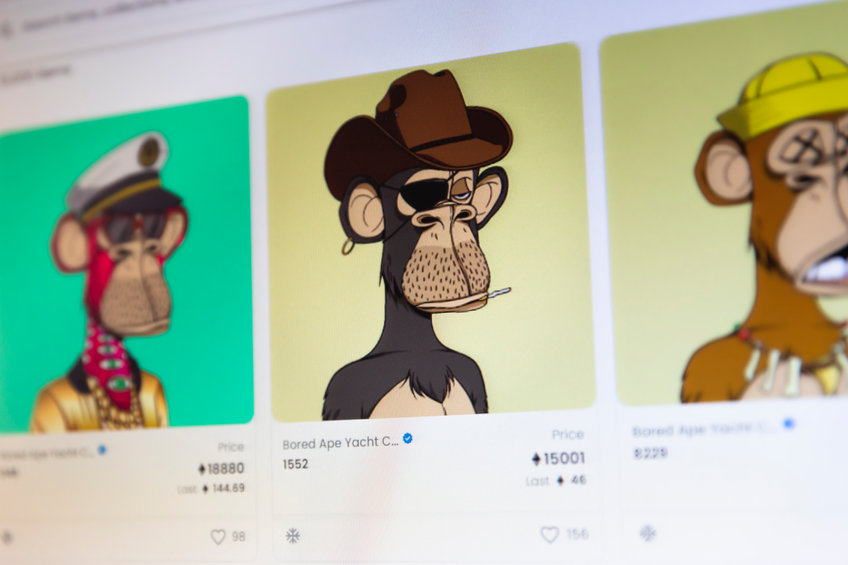

Otherside’s disastrous auction leaves many paying thousands of dollars in gas fees without receiving anything Yuga Labs refused to apologise, blaming Ethereum and citing the need to create its own blockchain to scale The entire episode sums up the increasing centralization of wealth in NFTs , with the average investor being priced in In many ways, the Yuga ecosystem looks like the exact opposite of what cypto is intended to be They always seemed a little cruel to me.) Yuga Labs, the company behind the Bored Ape Yacht Club, had its much-anticipated Otherside auction Saturday night, for the purchase of land in its upcoming metaverse game. The start-up, which was worth $4 billion before this weekend, had a pretty good weekend by all accounts, raising approximately $320 million from the auction. However, the windfall was the opposite of what happened for most investors. Due to colossal demand, Ethereum gas rates have hit the four digits, leaving many investors spending massive amounts of gas – and still not getting the land they wanted.

Table of Contents

predictable problems

The problem, however, is that everyone knew this was going to happen. Yuga’s auctions were incompetent, and it wasn’t just their blatant failure to optimize the contract. They also abandoned the Dutch auction that had originally been bullied, amid a complete lack of transparency, and belatedly announced the mandatory purchase of ApeCoin. Also, they failed to stop the mass cultivation of KYC wallets. Perhaps worst of all, they donated 15,000 to their investors, again amid a lack of transparency, which further crippled supply and boosted gas even further. All of this led to an entirely predictable gas war and many hopeful newbies losing thousands of dollars. While Yuga has said it will refund gas to those who failed the transactions, that doesn’t help the thousands who failed to secure the land – as the company refused to allow those who lost preference in any subsequent sale, a move seen by many in the community as very unfair.

I think @yugalabs can fix this. There are 100k deeds left that were going to distribute to current deed holders. They should WL all wallets that KYCed AND approved APE AND had enough APE to mint, but did not get to mint, and let them mint 1 over a week at 305 APE. Quick 🧵… — exlawyer.eth/tez (@exlawyernft) May 1, 2022

But the consequences are deeper, unfortunately. $100 million in liquidity was sucked out of the NFT space as traders sold their assets to accumulate the colossal amount of ETH needed to buy a lot (and also pay for gas). Etherscan crashed with all activity, and Solana also experienced an outage due to the cascading failure of the blockchain validators, following a flurry of post-auction bot activity. NFT collections elsewhere on Solana and Ethereum also saw prices fall as traders sold in bulk to get the funds into their wallets for the auction – an auction that preceded the deletion of many.

Waiting for months and checking the news every day…Did the KYC in time,bought Ape on high beacuse u annouced in the last minute,got ready 1ETH in metamask…got the shock with gas war…sent eth from binance to metamask…arrived 3 hours late…and no land…very disappointed — B Bernadett (@Bernadett_4) May 1, 2022

Yuga failed to analyze the situation

Yuga’s lack of transparency, consideration and empathy was very sad to see. Worse still, after being silent for much of the catastrophe, they posted the naive tweet below, showing that they have completely lost touch with the average investor. Refusing to apologise, they blamed Ethereum for the whole mess, stating that they need a chain of their own to continue their grand Web3 domain ambitions.

We’re sorry for turning off the lights on Ethereum for a while. It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to scale properly. We’d like to encourage the DAO to start thinking in this direction. — Yuga Labs (@yugalabs) May 1, 2022

Anyone remotely familiar with cryptocurrencies could have predicted this in advance, however, and the real fault lies with Yuga for not optimizing the contract. Is their solution now to create some sort of “BSC-style” centralized blockchain, and further expand their empire and power in space? As a reminder, this company already owns the biggest NFT project on the planet in Bored Apes, the intellectual property rights to the second largest collection of CryptoPunks, and its own currency with a market value of over $4 billion. Now, do they want their own blockchain too? Ethereum has issues, I won’t deny that, but with Merge coming they’re at least working on it. Not to mention the size of the community and the sheer number of incredibly smart individuals working in it. What exactly has the Bored Ape Yacht Club done for the community? What did Yuga Labs do?

Wealth Centralization

It’s the last episode that highlights just how unique the NFT world is becoming. What average investor has the wherewithal to spend four figures on gas plus the price of actual land (which was 305 ApeCoin, worth $7,000 on Saturday) for the chance to join the Yuga club? Increasingly, this is becoming a playground for the notoriously wealthy, where the consolidation of wealth is getting more dizzying by the day. Unfortunately, this is the exact opposite of what so many people love about cryptocurrencies – a more democratic, fairer and more accessible monetary infrastructure.

Coming from someone who got a free $40K claim and a plot of land, Web3 is headed in the wrong direction It’s just becoming a game of “sucks you shoulda had more money.” I had friends who were hyped who couldn’t afford the gas and thats bs This is just becoming a rich kids club — Justinn.eth (@Grove_x3) May 1, 2022

Also, many merchants bought ApeCoin from Yuga to make the purchase. ApeCoin, you may recall, was released to all Bored Apes holders in March. 10,094 coins appeared in each holder’s wallet, which equates to $150,000 at current prices. Of course, already owning an Ape, which currently has a minimum price of around $300,000, means that those who launched ApeCoin were already doing “well”. Not to mention the fact that ApeCoin’s tokenomics is very uneven, with 15% of the supply held back by Yuga Labs, 14% going to BAYC founders, 15% to BAYC’s first owners, and 8% working on the DAO launch. . For those who count, that’s more than half of the supply. This week’s Otherside auction is meant to finally be a route for “normies” to enter the ecosystem. However, most were unable to do so due to the gas war, and more were hampered by the fact that ApeCoin plummeted 40% after the auction woes. The holders of this coin, of course, are the same normies who failed to convert that ApeCoin into what they wanted – land on the Otherside.

I’m out on Yuga. Lost over half of my NFT portfolio in the last couple days trying to get Ape for this because they told us it would be achievable. They lied to us. Cost me over $10k and now I can’t even sell this plummeting $Ape for half what I paid for it. I’m gutted. — JungleGoat.eth (@JungleGoat) May 1, 2022

anti-crypt

As I said above, cryptocurrency should be a fairer system; a more accessible, open and democratic monetary environment. Tell me, what exactly is fair here? A quick browse on Twitter and you’ll see Ape holders criticizing those who complain about Saturday’s auction for not having the courage or the means to pay the hefty gas fees. HFSP, or NGMI, are the common acronym for those who have failed to secure a piece of land. I wonder how different their attitude would have been if they hadn’t gotten their hands on a monkey before the price skyrocketed to where it is now.

PERFECT LAUNCH! HAPPILY PAID 1.7 ETH IN GAS…THE FLOOR IS 8.5 ETH RIGHT NOW! STOP CRYING! —Cheetah Cowboy (@MetaverseWorld) May 1, 2022

As a die-hard cryptocurrency fan who spends half his time defending the industry to skeptics in trad-fi and beyond, it’s a disturbing day. It is a symbol of one of the oft-criticized features of cryptocurrency – the centralization of wealth. This was always meant to be the place for the underdog, where anyone could become anyone.

Going away

I will probably be dismissed as a disgruntled nobody; a normie who is sad not to have a piece of the BAYC empire. Honestly, this is kind of true – I don’t own any part of Yuga, and I’m sad, but not for that reason. I’m sad because I love cryptocurrencies and I love the opportunities they present. What I see in Yuga now is the opposite of what makes me so excited to be in this space; the opposite of why I quit my traditional job to make that leap. Of course, it would be nice to be in the Bored Ape Yacht Club for financial reasons. But now, it’s more like a Bored Ape 1% Club. I may remain poor, but at least I’ll have fun doing it.