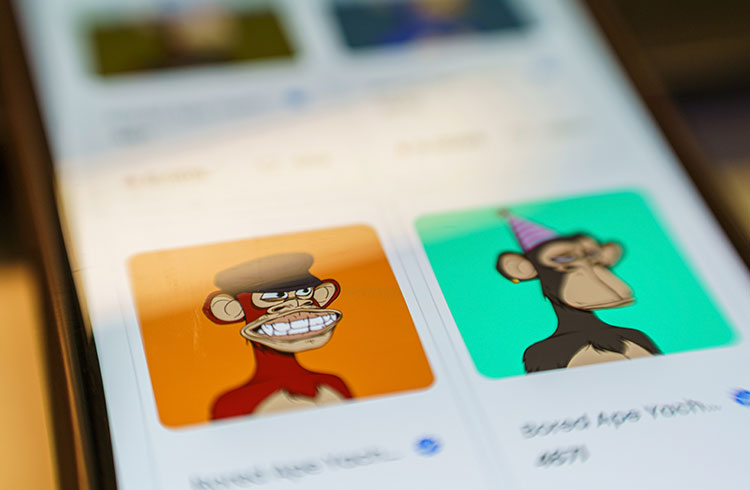

Cryptocurrency prices tumbled this week amid news of the FTX liquidity crisis and alleged mismanagement of client funds. But that turmoil may be spilling over into the NFT world, particularly in the popular Bored Ape Yacht Club (BAYC) collection. According to data from the NFT Price Floor website, the collection suffered losses between 7% and 13% in the last 24 hours. For example, the cheapest BAYC available on the market (i.e. the “minimum price”) is listed for 57.5 ETH as of press time, or around $76,400. Measured in Ether (ETH), the collection has seen a 7% drop in the last 24 hours. But measured in dollars, given the decreasing value of ETH (which is down 13% this week), it is down almost 24% the day before. Based on the current dollar price, the minimum price of a BAYC has plummeted since its peak of nearly $429K (152 ETH) on April 29 earlier this year. In other words, the famous bored monkeys suffer a more than 82% drop in less than seven months.

losing ground

However, BAYCs are not falling in price only in absolute terms, but in relative terms. That is, the bored monkeys are losing value while other relevant brands are growing. For example, the same NFT Price Floor shows that the floor price of the CryptoPunks collection has increased by 6% (in ETH) in the last 24 hours. With that, the value of NFT rose to 66.75 ETH, or around $88,700. Amid the new market struggles, some investors may view CryptoPunks as more durable assets that will have better value than other NFTs. After all, the collection is one of the most famous and pioneers in this market since 2017.

What happened?

There are a few potential factors that could be pushing BAYC prices down this week. Naturally, one of them is the general despair of the cryptocurrency market, because of the collapse of FTX. The exchange’s sudden drop left many investors illiquid as FTX blocked withdrawals for nearly 48 hours. As a result, some investors may have sold their “blue chip” NFTs amid the downturn. Interestingly, an analysis of the blockchain brings evidence of the occurrence of such an action. Data aggregated by Flipside Crypto shows a significant increase in OpenSea trading using Wrapped Ethereum (WETH) instead of standard ETH. According to the data, WETH’s share rose this week, surpassing the 50% mark at the end of Wednesday (9). Bidding on an NFT on OpenSea requires WETH, so when that number increases, it means more NFT owners are accepting offers made on their assets. Bids are generally below market value on virtually all NFTs. Therefore, the data suggests that sellers are accepting low offers to sell quickly amid market chaos. Another element linked to the cryptocurrency market decline is BendDAO, a lending protocol that allows users to obtain cryptocurrencies using NFTs as collateral. BendDAO is currently auctioning off 14 BAYC obtained from liquidated loans, with all current bids well below the floor price in major markets. This could suggest weak demand for NFTs, which helps to squeeze prices further. In August, BendDAO itself faced a significant liquidity crunch when it ran out of ETH and was not getting bids high enough to auction the NFTs seized from liquidated loans. Ultimately, protocol members voted to lower the settlement threshold to make it easier for BendDAO to auction the NFTs.