In recent months, with the downturn in the crypto market, DeFi projects that offered high annual yields had to break this cycle, giving way to protocols that offer lower but more sustainable yields. Based on this, cryptocurrency analyst Stefan Stankovic has listed three projects that offer good “real returns” to investors. According to the analyst, the term “real yield” refers to protocols that encourage token ownership and liquidity mining by sharing the profits generated by fees. “Real yield protocols often return real value to stakeholders by doling out fees in USDC, ETH, and their own tokens that have been taken off the market through buybacks or other tokens that they have not issued,” he explained.

GMX (GMX)

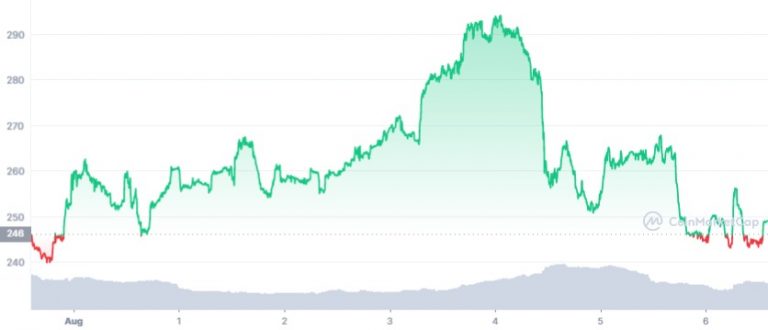

The first project that offers “real income”, according to Stankovic, is the GMX. It is a decentralized exchange (DEX) that has a native token with the same name. As the analyst highlighted, in the last week, the GMX token reached a local peak of BRL 293, after rising more than 20% in two weeks.

GMX token price chart. Source: CoinMarketCap About the project itself, Stankovic explained that it has two native tokens: the GLP and the GMX. The GLP represents an index of the assets available for trading while the GMX is the governance and revenue sharing token. The protocol currently offers 14% APR for staking GMX and 28% for GLP. According to Stankovic, this income is guaranteed through organic profit sharing rather than diluted token issuance: “[O rendimento] proved attractive to liquidity providers and governance token holders. As a result, GMX has amassed the highest liquidity on Arbitrum (over $304 million in TVL) and has one of the highest staking rates for its governance token.”

Synthetic (SNX)

Second, the analyst highlighted the Synthetix (SNX) project. It is a decentralized protocol for trading synthetic assets and derivatives. Stankovic pointed out that the project has revamped its tokenomics model to provide real income to SNX holders. As per Token Terminal data, the protocol generates an annual revenue of around $82 million, and the total sum goes to SNX participants. With SNX priced at around US$3 (R$15) and a fully diluted market cap of around US$870 million, the token’s price/earnings ratio is 10.47x.

SNX token price chart. Source: CoinMarketCap Also, the current APR for SNX staking is around 53%. Part of the income comes from staking rewards and part from trading fees in the form of sUSD stablecoins. “As some liquidity mining rewards come from inflationary token issuances, Synthetix is not a pure real yield protocol. Still, it is one of the top DeFi revenue-generating protocols, offering one of the highest mixed yields for staking.”

Dopex (DPX)

Finally, the analyst cited Dopex, a platform built on Arbitrum, which allows users to buy or sell options contracts and earn real passive income. The main product of the project is the “Single Staking Option Vaults”, which provide liquidity for option buyers and automated passive income for option sellers. In addition, Dopex also allows users to bet on the volatility of certain assets through so-called “Atlantic Straddles”. According to the analyst, while all Dopex products allow users to earn real income by taking some risk, the protocol also generates real revenue through fees. He noted that 70% of fees go back to liquidity providers, 5% to delegates, 5% to buy and burn the protocol’s rDPX token, and 15% to governance participants. “As with Synthetix, some of the staking income for DPX comes from diluted token issuances. This means that the liquidity mining model is mixed. Dopex currently offers around 22% APY for staking veDPX – a ‘vote-guaranteed’ DPX, which remains locked for four years,” he pointed out. The project’s native token, DPX, currently costs BRL 2,072, having dropped 13% in the last 24 hours.

DPX token price chart. Source: CoinMarketCap Also read: Ethereum can reach BRL 10,000 with The Merge Also read: Marathon restarts 25,000 miners and produces 184 Bitcoins in August Also read: Bitcoin Analysis; BTC in historic buy region