In many places in our cities, you can see a lot of vacant commercial premises. These are mainly premises for small and medium-sized businesses, on which many jobs or, ultimately, the Polish economy depend. The visual feelings here are not glued to the statistical data on the number of bankruptcies of enterprises in Poland. At first glance, the last two years emerge with significantly more bankruptcies!

A sharp increase in the number of bankruptcies in 2021

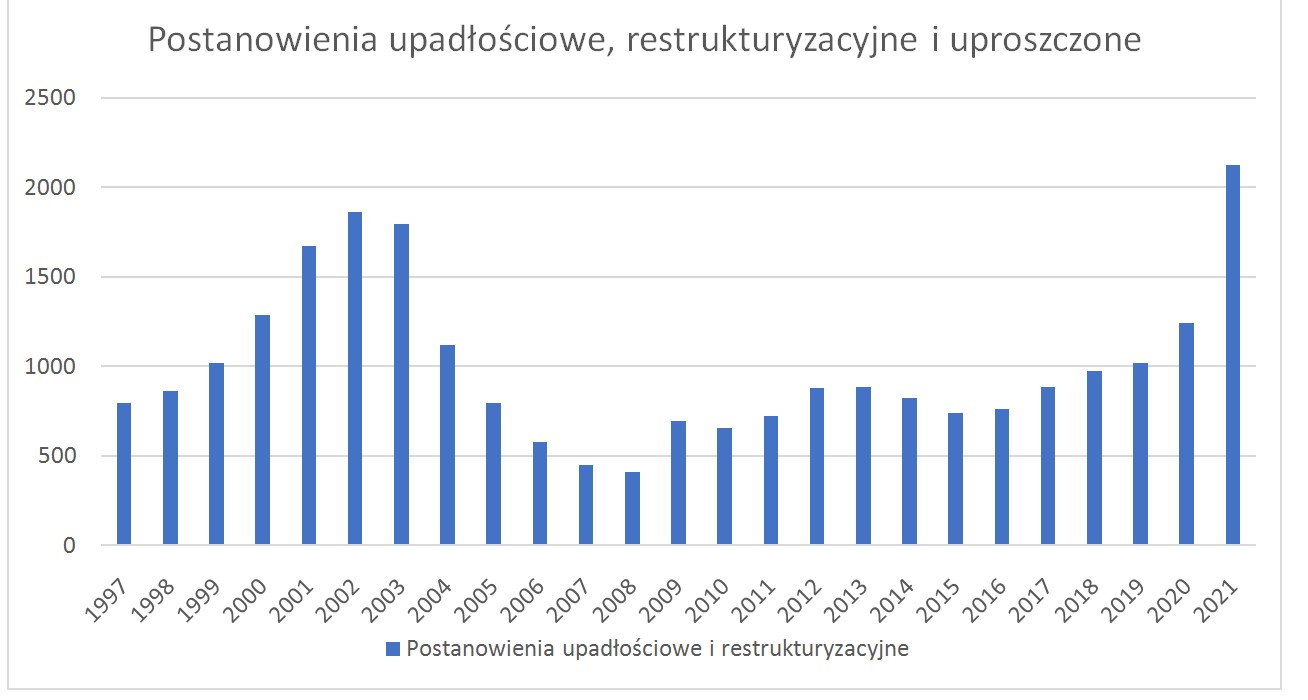

Each bankruptcy, regardless of the type of proceedings, is delayed in time compared to the actual moment of default (non-payment and non-payment of liabilities). Nevertheless, the trend of such data, or “peaks” of the charts, says a lot about the situation of smaller businesses. Looking at the figures from the level visible in 2019 (1019 company bankruptcies), we see an increase in bankruptcies to 2125 proceedings in 2021! A large part of bankruptcies, in particular simplified proceedings, concern sole proprietorships (small companies which are the most numerous in the national economic ecosystem, i.e. about 97% of the 2.2 million enterprises). It is true that over the years the number of economic entities has increased, so a certain percentage of the increase in bankruptcy can be attributed simply to the increase in the number of economic entities in Poland, but this is not a whitewashing observation.

Source: Coface annual reports on corporate insolvency in Poland. Importantly, the scale of increases in insolvency shown above is very dynamic (we are talking about an increase of over 100% compared to 2019). We should not try to interpret data in a way that is detached from the logic of economics. Indicated 2 thousand. of companies is a small size in relation to the total of 2.2 million entities mentioned above, however, we should remember that these bankruptcies are a “hard landing” where the company’s owners have lost control over the financial liquidity of their company (there are many injured creditors). The statistics also do not directly show the scale of the liquidity problem, as many enterprises are still in the market, but are struggling with losses and payment gridlocks. Moreover, the deterioration in liquidity is “broad”, ie it affects the entire economy and many industries, not only gastronomy or the hotel industry. Paradoxically, the only industry in which it was better in 2021 than in 2020 was the entertainment, recreation and sports sector. This sector has been hit hard in 2020 and we are dealing with a rebound effect from a low base rather than a significant improvement in the business environment. Unfortunately, in my opinion, this is not the end of the period of an increased number of proceedings. With a high degree of probability, the hard landing concerned the least resilient businesses in the first place. Many companies are able to survive for some time with the great effort of their owners (as well as their private savings). However, in the long run, unprofitability means bankruptcy or the controlled liquidation of companies. These are the laws of the economy that cannot be defended by any political shield. Author: Wawrzyniec Bąk, analyst at Prosper Capital Dom Maklerski

Source: Coface annual reports on corporate insolvency in Poland. Importantly, the scale of increases in insolvency shown above is very dynamic (we are talking about an increase of over 100% compared to 2019). We should not try to interpret data in a way that is detached from the logic of economics. Indicated 2 thousand. of companies is a small size in relation to the total of 2.2 million entities mentioned above, however, we should remember that these bankruptcies are a “hard landing” where the company’s owners have lost control over the financial liquidity of their company (there are many injured creditors). The statistics also do not directly show the scale of the liquidity problem, as many enterprises are still in the market, but are struggling with losses and payment gridlocks. Moreover, the deterioration in liquidity is “broad”, ie it affects the entire economy and many industries, not only gastronomy or the hotel industry. Paradoxically, the only industry in which it was better in 2021 than in 2020 was the entertainment, recreation and sports sector. This sector has been hit hard in 2020 and we are dealing with a rebound effect from a low base rather than a significant improvement in the business environment. Unfortunately, in my opinion, this is not the end of the period of an increased number of proceedings. With a high degree of probability, the hard landing concerned the least resilient businesses in the first place. Many companies are able to survive for some time with the great effort of their owners (as well as their private savings). However, in the long run, unprofitability means bankruptcy or the controlled liquidation of companies. These are the laws of the economy that cannot be defended by any political shield. Author: Wawrzyniec Bąk, analyst at Prosper Capital Dom Maklerski

The author also recommends:

Follow us on Google News. Search what is important and stay up to date with the market! Watch us >>