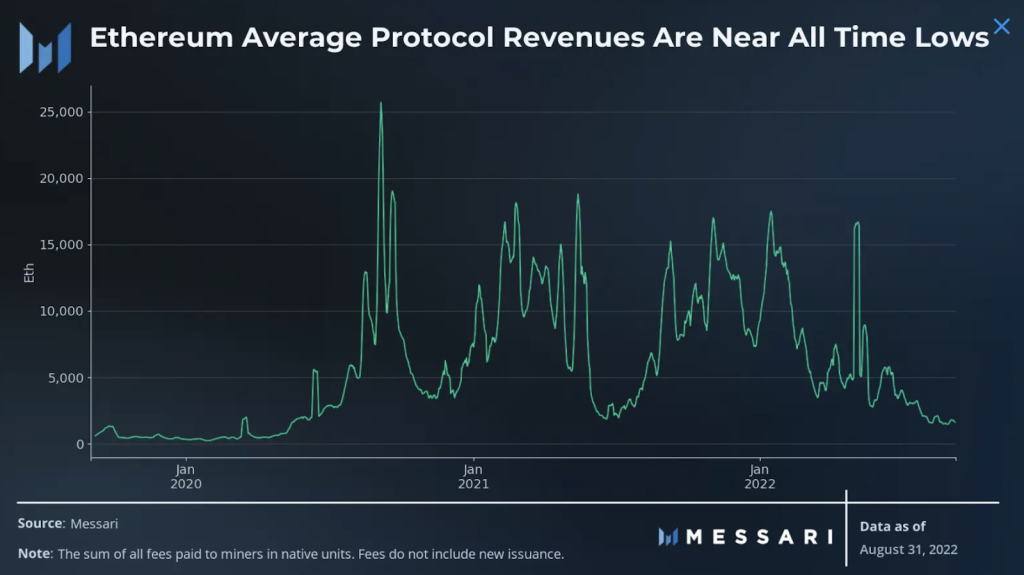

Ethereum revenue “fell off a cliff” in Q3 2022, “squeezing” staking earnings in the process, according to a recent report by cryptocurrency research firm Messari. Ethereum generated nearly 137,000 ETH in transaction fees. , also known as “gas fees”, between July and October. The number is below more than a million in the first three months of the year. The drop was more pronounced between the second and third quarters, with a 74% drop in tariffs.

Ethereum Revenues – Source: Messari Along with the Ether price drop, the decline in fees meant that Ethereum generated around $200 million in Q3. That’s more than a 90% drop from the average of $2 billion to $3 billion in each quarter of 2021, according to Tom Dunleavy, a senior research analyst at Messari and one of the report’s co-authors. . Ethereum traded above $3,800 earlier in the year, according to data from The Defiant Terminal. On Wednesday, it was around $1,350.

ETH Price, Source: The Defiant Terminal The authors attribute the drop to the bear market, increased adoption of Ethereum’s Layer 2 blockchains, and an upgrade to the gas-guzzling OpenSea NFT market.

Layer 2 Scale

Ethereum’s fluctuating, and often high, transaction fees have been one of blockchain’s main obstacles to wider adoption. In this regard, several “layer 2” blockchains built on top of Ethereum aim to solve this. “The Ethereum rollup-centric scaling plan is finally materializing,” the authors wrote. “While Ethereum’s average transaction count may have remained range-bound, there has been significant growth in transactions in the L2.” The most popular Layer 2 protocols on Ethereum are Arbitrum and Optimism. Each of them has tripled their daily transactions since the beginning of the year.

OpenSea update

The overall cost of transactions on Ethereum also dropped in Q2. This is because there has been an update in the OpenSea NFTs market, one of the most popular platforms on the blockchain. After the update was released, OpenSea estimated that it would reduce the cost of buying and selling NFTs on its platform by more than a third.

Ether staking rewards

To secure the Ethereum network, users must “lock in” their ETH in exchange for a modest reward, which is currently around 5%, according to stakingrewards.com. This reward is based, in part, on the fees paid on each transaction. While the base fee continues to burn as per EIP-1559, the tip fee that was once for miners now flows into ETH stakers after The Merge. Thus, if network activity continues to decline, it could further reduce staking yields, according to the co-authors. Whether that will happen, however, is anyone’s guess, Dunleavy acknowledged in a message to The Defiant. But the proliferation of L2s, he continued, “probably means that this level of fees (or around that level) will be maintained.”

Warning: The text presented in this column does not necessarily reflect the opinion of CriptoFácil.