The deteriorating “terms of trade” of the euro area, resulting from rising natural gas and electricity prices, continue to weigh heavily on the single currency, and as the heating season approaches, we will face a test of European energy security. While European natural gas storage facilities, on average, have exceeded the 80% fill ceiling, the much higher energy costs will be structural, which Danske Bank believes creates an opportunity for EUR / AUD “shorts”, with a target of 1.30.

Russian gas and euro quotations

Danske Bank analysts say that the decline in energy supplies from Russia contributes to a permanent, negative shock related to the “terms of trade” (relations between export and import prices), which will, in a structural and not temporary way, change the orientation of European countries from the east to other directions. It therefore benefits alternative suppliers of natural gas and LNG in the global market and. – We expect that the tightening of global financial conditions will weigh on commodity exporters and cyclical currencies against the USD. We recommend shorting EUR / AUD as a relatively probable scenario in the face of the deepening energy crisis, Danske Bank analysts wrote. Experts add that although Germany was able to replenish its natural gas reserves faster than expected, it is clear that in the future the EU will be increasingly dependent on global LN markets to replace supplies from Russia. Although investments in new LNG terminals will allow countries to use more of the raw material, its global supply remains limited.

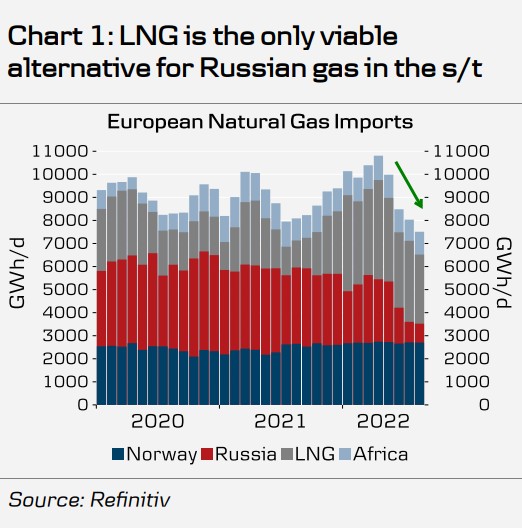

LNG seems to be the only viable alternative to Russian gas Source: Refinitiv In the spring, the EU was able to replace most of the decline in Russian gas imports with LNG, but in summer total imports fell sharply, as shown in the chart above. Before the war, Russian natural gas exports to Europe amounted to approximately 11.4 billion m3 of LNG per month. For comparison, in the first half of 2022, the total global LNG imports averaged around 46.7 billion m3 per month, which means that even if we assume that Russia will find new recipients, full replacement of all Russian supplies would require at least a 20% increase in global supply. LNG.

LNG seems to be the only viable alternative to Russian gas Source: Refinitiv In the spring, the EU was able to replace most of the decline in Russian gas imports with LNG, but in summer total imports fell sharply, as shown in the chart above. Before the war, Russian natural gas exports to Europe amounted to approximately 11.4 billion m3 of LNG per month. For comparison, in the first half of 2022, the total global LNG imports averaged around 46.7 billion m3 per month, which means that even if we assume that Russia will find new recipients, full replacement of all Russian supplies would require at least a 20% increase in global supply. LNG.

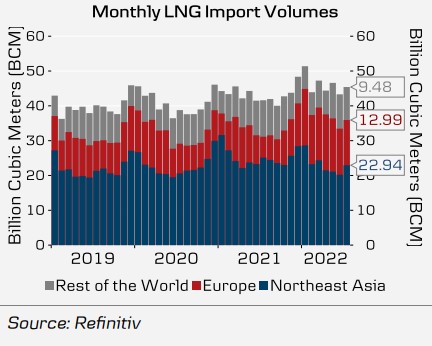

Monthly volume of LNG imports. Source Refinitiv Interestingly, between 2021 and 2022, average monthly LNG imports to the EU increased by 60%, against just a 6% increase in global imports, suggesting that the EU benefited from weaker COVID-driven demand from China in the first half of the year. – Europe’s dependence on imported raw materials, combined with the persistent negative supply shocks, has led to a significant deterioration in the condition and prospects of the euro area. Moreover, the depleting supply of not only natural gas, but also crude oil and a few industrial metals means that central banks cannot risk “switching” the tightening cycle too early. In our opinion, a more risky scenario would assume anticipatory easing and continued upward pressure on commodity prices, which could potentially lead to a wave of stagflation, analysts added.

Monthly volume of LNG imports. Source Refinitiv Interestingly, between 2021 and 2022, average monthly LNG imports to the EU increased by 60%, against just a 6% increase in global imports, suggesting that the EU benefited from weaker COVID-driven demand from China in the first half of the year. – Europe’s dependence on imported raw materials, combined with the persistent negative supply shocks, has led to a significant deterioration in the condition and prospects of the euro area. Moreover, the depleting supply of not only natural gas, but also crude oil and a few industrial metals means that central banks cannot risk “switching” the tightening cycle too early. In our opinion, a more risky scenario would assume anticipatory easing and continued upward pressure on commodity prices, which could potentially lead to a wave of stagflation, analysts added.

Trade Forex CFDs with Capital.com. Get access to thousands of markets around the world

START INVESTING Regardless of the ECB’s decisions, both scenarios – ie further tightening of financial conditions or stagflation – draw very negative prospects for the EUR. In addition to the growing dollar, exporters of goods will gain a decisive advantage.

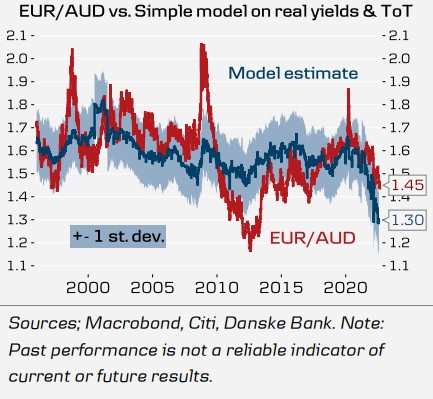

EUR / AUD forecast based on real profitability difference Source: Macrodand., Citi, Danske Bank – In our opinion, Australia stands out as, next to the USA and Qatar, it is one of the largest LNG producers in the world markets. Despite the tightening global financial conditions and weak growth in the key export market of China, Australia’s position continues to strengthen as LNG prices rise. Our model, based on relative trading conditions and the real difference in yield, shows a further downside potential for EUR / AUD close to 1.30. Key risks to the cross include the sudden easing of fears of gas shortage, as well as the fact that the expensive Australian housing market is now more exposed to rising global yields. We suggest a short EUR / AUD with a spot price of 1.308, a target at 1.30 and a hard stop-loss at 1.5300. Alternatively, we see value in other commodity exporters as well and see a similar option in the EUR / CAD pair, Danske Bank analysts wrote.

EUR / AUD forecast based on real profitability difference Source: Macrodand., Citi, Danske Bank – In our opinion, Australia stands out as, next to the USA and Qatar, it is one of the largest LNG producers in the world markets. Despite the tightening global financial conditions and weak growth in the key export market of China, Australia’s position continues to strengthen as LNG prices rise. Our model, based on relative trading conditions and the real difference in yield, shows a further downside potential for EUR / AUD close to 1.30. Key risks to the cross include the sudden easing of fears of gas shortage, as well as the fact that the expensive Australian housing market is now more exposed to rising global yields. We suggest a short EUR / AUD with a spot price of 1.308, a target at 1.30 and a hard stop-loss at 1.5300. Alternatively, we see value in other commodity exporters as well and see a similar option in the EUR / CAD pair, Danske Bank analysts wrote.

Trade Forex CFDs with Capital.com. Get access to thousands of markets around the world

START INVESTING

The author also recommends:

Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>