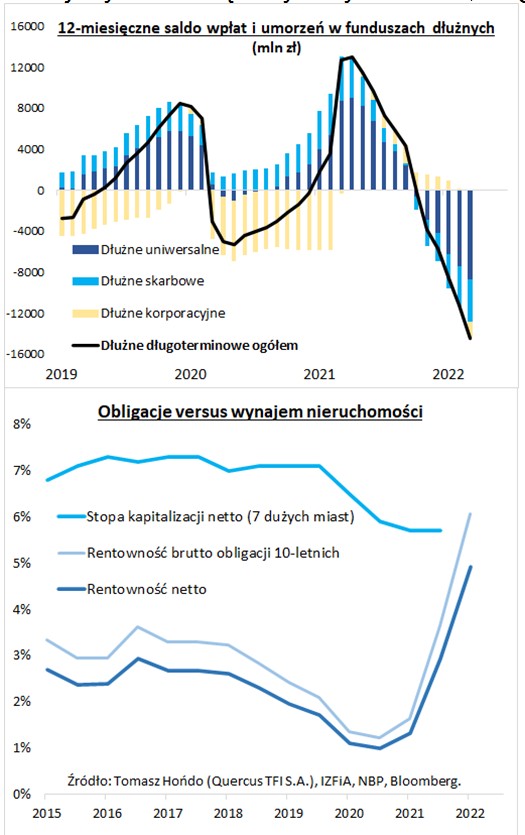

The Polish treasury bond market is undergoing a painful process of adjusting to ever higher interest rates. Fixed rate bonds, of course, are the most affected, but the sell-off is also radiating to other segments of the debt market. The latest data from the Chamber of Fund and Asset Managers show that over the last 12 months, over PLN 14.4 billion net outflows from long-term debt funds, of which PLN 4.2 billion was for Treasury bond funds. In addition, there were almost PLN 11.9bn net amortizations of short-term debt funds. In the article you will learn, among other things:

Table of Contents

Inflation creates a new reality

The mechanism of the proverbial vicious circle worked here, i.e. the sell-off of bonds caused a decrease in the value of fund units, which, in turn, prompted more clients to withdraw their capital, and this in turn forced the funds to sell off the most liquid securities, which in turn contributed to … a further decline in bond prices . It can be assumed that this vicious circle could be broken with the emergence of the market belief that there is an imminent, definitive end to interest rate increases. However, it is already visible that the yields on government bonds are starting to look quite impressive years later, at least in nominal terms. The profitability of benchmark fixed-coupon securities with maturity in approx. 10 years is – at the time of writing this article – approx. 6%. per year. Importantly, even securities with relatively short maturities – two years or even one year – have already achieved slightly lower yields. This profitability consists of both the interest rate and the fact that the vast majority of fixed-coupon bonds are listed on the secondary market at a greater or lesser discount to the nominal value at which they will be redeemed.

Profitability around 6 percent. means that for the first time in years, government bonds are starting to compete with… real estate. The simplified estimates of the National Bank of Poland for the fourth quarter of 2021 show that the average capitalization rate on a representative investment in housing for rent was 5.7%. This is a value after lump sum taxation, so in order to achieve comparability, we must also take into account the tax in the case of bonds (“Belka tax” of 19%), which reduces their net profitability to about 4.9%. In this perspective, real estate still remains the top, although only by a modest 0.8 percentage points. percent In summary, real estate investments still have many advantages, but over the last year they have grown into a serious competitor. Due to a deep sell-off, fixed-coupon treasury bonds offer a yield of 6%. gross (and slightly below 4.9% net), which is starting to boldly compete with the yields on rental property, which have significantly decreased over the last two years, but the advantage of real estate is the fact that the overall rate of return is not only due to the capitalization rate from rental, but also long-term increase in value. On the other hand, with rapidly growing mortgage installments, one may wonder if property values will be under pressure after years of boom? Author: Tomasz Hońdo- Senior Economist, Quercus TFI, Editor of Qnews.pl

Is it time for bonds?

In the above article, Tomasz Hońdo compares the profitability of bonds to the profitability of renting apartments, which are already starting to approach each other, although in the case of apartments, the costs of repairs and renovations should also be taken into account. In this comparison, government bonds, given their maintenance-free and risk-free nature, are beginning to be a viable alternative to rental housing, especially considering that high interest rates, in general, are not conducive to house price increases.

At the same time, when comparing investments in treasury bonds with a fixed interest rate – with Polish equities, it turns out that in this case the risk premium from investment in shares (WIG) also decreased very quickly recently, and when 5-year bonds reached a profitability of 6, 7%, it even became negative. This means that – for the first time since 2008 – investments in treasury bonds can compete – in terms of expected profitability – with investments in shares from the WIG index, however, they are characterized by a much lower risk of price fluctuations and a risk of insolvency close to zero. Here we come to the key issue, i.e. the risk in the bond market. Recently, changes in bond prices have taken their toll on investors who did not expect such volatility from them. This is perfectly reflected in the chart in the quoted comment by Tomasz Hońdo, showing the 12-month balance of payments and amortizations in debt funds. It clearly shows that the bond market, as well as the stock market, is primarily ruled by emotions, because how else to explain the record inflow of money to bonds at the beginning of 2021, when their yields were not much higher than 0% and today’s situation when we have record outflows, and bond yields can successfully compete with other much riskier or less liquid alternatives? Of course, the situation has changed a lot, especially with regard to the inflation and interest rate outlook, which always has a strong impact on the prices of long-term fixed-rate bonds. In fact, few people had enough imagination to forecast a 20% drop in the valuation of government bond funds a year ago. Such huge losses, however, do not release investors from using cold calculation, instead of emotions, when making investment decisions. The profitability of the order of 6.5% for bonds with a fixed interest rate means that – with the interest rates unchanged – we will get nearly 20% of the profit from interest only, after 3 years. If we assume that interest rates drop even slightly during this time, the time to receive such a profit will be significantly shortened. Is there a chance, then, that interest rates will change their trend to a downward trend in the near future? Looking at the current world situation, the inflation prospects and CEO Glapiński’s assurances about a determined fight against inflation do not inspire optimism in the coming months. As for the further future, positive premises for this market are provided by the inverted yield curve of Polish bonds, i.e. for example, 2-year bonds today have higher yields than 10-year bonds. This is an exceptional situation, which most often means that we will face an economic slowdown, during which rates will have to be reduced, so the high-interest fixed-rate bonds bought today will be worth more in the future (in an environment of lower rates). For now, bond prices are still in a downward trend (yields are rising). However, when analyzing investment alternatives, we will quickly come to the conclusion that the time has come to start looking closely at this asset class. Author: Grzegorz Chłopek, Managing Director, iWealth and Jacek Maleszewski, Director of the Advisory Team, iWealth.

Gold, inflation and geopolitical tensions

Gold bullion, which is usually perceived by many investors as a “safe haven” in times of a tense global situation, recorded in March this year. The rise in prices above $ 2,000 per troy ounce as investors sought to protect their capital from inflation and political turmoil. On March 8, gold futures contracts stabilized slightly above $ 2,043 an ounce, approaching $ 2,069, the highest end-of-day price level in history in January 1975. In February and March this year. gold outperformed other safe assets, including US Treasury (where bond attractiveness declined due to heightened inflation), as well as Japanese Yen and Swiss Franc. Sanctions imposed by Western countries on Russia prompted the Central Bank of the Russian Federation to announce the resumption of purchasing this precious metal after a nearly two-year break. In the past, the above-mentioned the bank was buying up gold produced in Russia as part of increasing its budget reserves, but now it can see the benefits of strengthening existing sources of supply as gold is not linked to any country or financial system.

Rising global inflation is another factor supporting gold prices this year. In particular, in the beginning of 2022, the rise in the prices of consumer goods and services in the US accelerated, pushing the annual inflation rate to the highest level in four decades. Demand for gold coins and bars has been solid over the past few years, with recent geopolitical events apparently fueling it. Premiums against spot prices rose in several markets, reflecting the shortfall in the supply of physical gold in relation to demand.

The three most important sources of value

Gold is performing well, but we still see a number of factors that have the potential to push gold prices to even higher levels. We believe gold may gain in line with successive waves of increased market volatility and lingering concerns about the economic consequences of the coronavirus. The war between Russia and Ukraine has further exacerbated the uncertainty in the world economy. Traditionally, gold has a very low correlation with other asset classes, which favors greater interest among investors looking for portfolio diversification tools in volatile market conditions. As investors buying stocks in gold mining companies, we seek exposure to the three most important sources of value in the industry: (1) exploring new deposits, (2) successfully developing new mines, and (3) efficient use of metal mining assets, with an emphasis on generating large, free cash flow. Gold market trends are one of the key determinants of a stock’s short-term performance, but we believe the long-term dynamics of the industry should also be looked at. The average price of an ounce of gold over the past two years has been over $ 1,750, and this price level supports the high profitability of most gold producers. Higher by-product copper premiums further increased cash flow in 2021 and early 2022, amid a record-breaking narrow supply-demand gap in the global copper market, which in many cases helped offset the single-digit cost inflation that is currently listed – in the broadly understood – mining industry. Author: Steve Land, Vice President, Analyst, Portfolio Manager, Franklin Equity Group

The author also recommends:

Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>