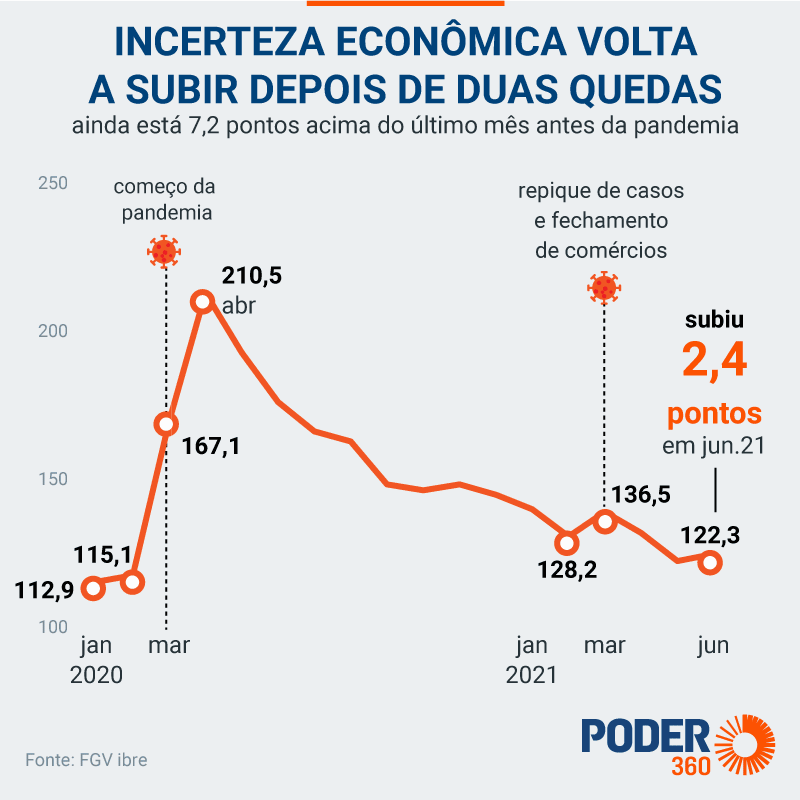

The IIE-Br (Economic Uncertainty Indicator) of the FGV (Fundação Getúlio Vargas) rose 2.4 points in June, to 122.3 points, after two consecutive drops in April and May. Among the reasons for the increase in uncertainty are the pandemic, the water crisis, tax reform discussions in Congress and the political risk resulting from possible consequences of Covid’s CPI. Here is the analysis by FGV (279 KB). According to economist and researcher at FGV Anna Gouveia, the level considered “adequate” is below 110 points. “The indicator for April 2020 reached a very high level because of the pandemic and then there was a drop. In late 2020 and early 2022 it slowed down and had some fluctuations. In June, it rose again. The current level is considered high and is still 7.2 points above the pre-pandemic period.” In March 2022, the index rose 8.3 points due to the increase in the number of covid cases, and the imposition of blockades and closing of stores in several cities in Brazil. In April and May, the index dropped by 7.1 and 9.5 points, respectively. However, in June, uncertainty rose again. According to Anna Gouveia, the vaccination campaign is still slow, with results below expectations. In addition, the water crisis also contributed to the increase in uncertainty in June. “The possibility of a blackout contributes to the increase in uncertainty. In addition, the consumer will have to pay a more expensive electricity bill and will need to save energy. All of this impacts productivity,” he says. In addition, the discussions on tax reform in Congress are also a factor of uncertainty. “Knowing how much will be taxable on companies, this impacts consumption and investment”. Another point that contributes to the uncertainty scenario, according to Anna Gouveia, is the political risk related to possible consequences of Covid’s CPI and recent suspicions of irregularities in the negotiation of vaccines. business because it is not possible to measure the return on investments”. The Economic Uncertainty Indicator is composed of 2 components:IIE-Br Media – based on the frequency of news mentioning uncertainty in print and online media, and

built from the individual standards of each newspaper. It is the most weighty component; IIE-Br Expectation – constructed from the average of the coefficients of variation of analysts’ forecasts

economic indicators, reported in the Central Bank Focus survey, for the exchange rate and the Selic rate 12 months ahead and

for the accumulated IPCA for the next 12 months. It has less weight. The 2 walked in the opposite direction in June. The Media component rose 4.7 points, to 121.7 points, contributing positively by 4.1 points to the increase in the IIE-Br in the month. The Expectation component, which measures the dispersion of forecasts for the following 12 months, retreated by 7.7 points, to 115.7 points, contributing in a negative way, by 1.7 points, to the evolution of the aggregate indicator’s margin. continue reading

Indicator that measures uncertainty with the economy rises again in June