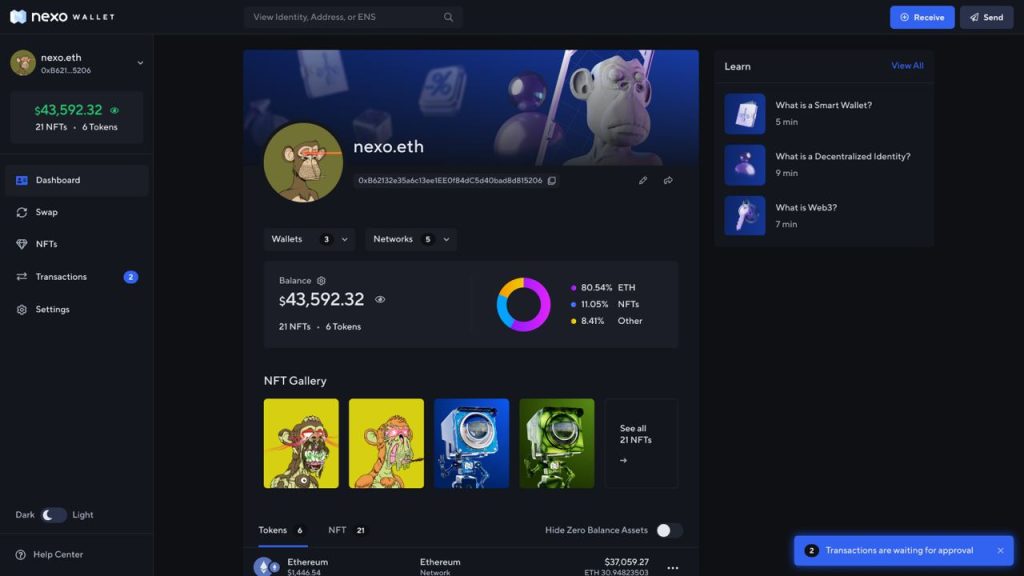

It’s been a chaotic week in the cryptocurrency space, with yet another centralized company – this time FTX – going bankrupt. Given this scenario, the very important issue of custody of assets gained prominence. I wrote an article yesterday analyzing how funds were flowing out of exchanges because of this, as investors got spooked and rushed to emergency exits. So it is interesting in this climate that Nexo, a cryptocurrency lending platform, has launched a non-custodial smart wallet. Currently in pre-launch phase, the product is a self-governing option to send, receive, store and exchange digital assets and operates on five chains: Ethereum, Polygon, Binance Smart Chain, Fantom and Avalanche-C. We interviewed Product Owner Elitsa Taskova to get some answers about the announcement.

Bitcoin Guide (GB): Crypto custody is obviously a hot topic after recent events in the industry. Do you think this might encourage the adoption of this non-custodial wallet?

Elitsa Taskova (ET): Sure, definitely. Naturally, Nexo Wallet has been in development since the beginning of the year. At Nexo, we want to ensure that clients can choose the level of centralization and decentralization they want to have in managing their funds. We’re aiming for the stars and want to create Nexo 360º – a complete offering that contains everything a person could need to manage their money. Secure, easy-to-use, non-custodial access to DeFi is part of this package, as is the ability to manage your own digital identity without the need for a middleman.

GB: It is interesting that this wallet is released to be compatible with multiple blockchains. How difficult was it to develop this as opposed to, say, just launching on Ethereum?

ET: We will start by supporting a few EVM-compatible chains – this reduces the initial complexity a bit, but we are also definitely looking to support other chains with upcoming product releases, including Bitcoin. Additionally, we are currently evaluating whether providing a multi-chain bridge is something we want to leverage to facilitate users’ needs when navigating across chains.

GB: At the same time, Nexo is a centralized company. Many of its competitors have gone bankrupt in the last year. While this has nothing to do with Nexo, do you fear that capital will leave this space completely, with Nexo – like many crypto companies – taking a blow to the overall reputation of cryptocurrency?

ET: We believe that capital is not what makes this sector valuable and advantageous – it is blockchain’s innovation and potential to solve inefficiencies in various sectors, most notably finance, that adds value to the world. The space received numerous alerts alluding to this throughout the year and, while we recover, we can only do our best, do more and bring this innovation to our daily lives. Indeed, the high levels of fear in the space are causing many users to cut back on their cryptocurrency investments, but as always, once the volatility subsides, they will return. Just as they have done in previous turmoils, for example the initial COVID panic in early 2020. In the meantime, we will continue to build the necessary infrastructure for them.

GB: How frustrating is it to see overleveraged and poorly managed companies do so much damage to the space while you are trying to build and innovate?

ET: It’s frustrating, but it hasn’t affected our zeal to keep building. At the very least, it has fueled our work towards sustainable and compliant practices and products. This has eroded confidence in cryptocurrencies and cast a serious shadow on the lending and financial management sectors of the digital asset space. My colleagues and I naturally empathize with the numerous retail users affected by the recent concussions in the space. And yet, at the same time, Nexo’s core business practices, risk management and sustainable model have proven once again that they can withstand such turmoil.

GB: With the economy at large and the cryptocurrency space struggling, how challenging is it to launch new products in this market?

ET: In those moments, you have to be focused and keep building, otherwise we run the risk of the long-term vision being clouded by short-term stressors. And that’s an unhealthy way to build something sustainable. While participation in the crypto space can be undermined in severe market downturns, this hardly eliminates the need for and viability of a product like the Nexo Wallet. In other words, we’ve never been afraid to face temporarily slower adoption by creating something that will survive the current market cycle and deliver immense value to end users.