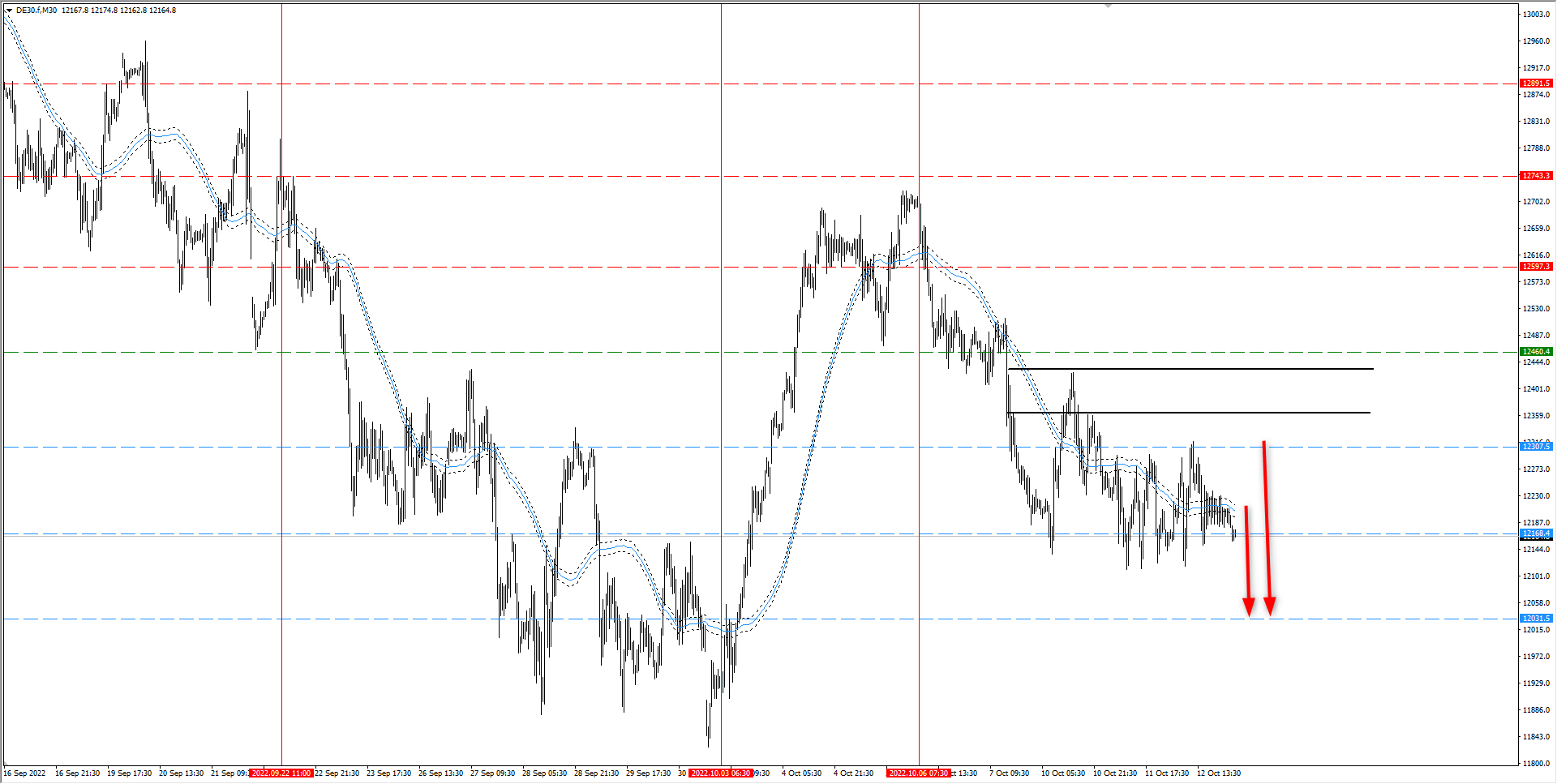

PSV strategy – is a daily cycle of analyzes and plays based on three main elements: pivot, sequence and volume, and two elements supporting the decision-making process. This cycle not only approximates the use of the method but also estimates the successive steps of the DAX index. A series of analyzes created under the patronage of Interactive Brokers. The analyzes are focused on the German DAX index. The market still generates exactly the same signal (sustained) The situation will change only after the break of 12,460 points (sustained) The target for him may be the S3 region at 12,030 (TP1) (sustained) The partner of the article is Interactive Brokers, check the offer now

Intraday: DAX still targeting S3

Slightly exaggerated optimism broke into the assumptions of many, when during the last session, writing about further declines met with numerous statements entitled “Now the market will not go down anymore” or “now we are going pretty much up”. Apart from the established approach adjustment, within the limits of the established adjustment, nothing has happened. The market is still in a downward trend, while sequentially struggling for maintenance, but not for increases so far. These will only appear after exceeding the PK range as described during the last session. Therefore, the sentiment should still be pro-downturn and each approach, especially as shallow as the S1 intraday just to the resistance (yes, at this point it is resistance for the market, not support) should be treated only as an opportunity for short / distribution. Therefore, the drops are still sustained, and after possibly exceeding the CP and maintaining such a move (which is currently within 42% in my opinion), we will revise these assumptions.

DAX H1 13.10.2022 I WANT TO INVEST WITH INTERACTIVE BROKERS

DAX H1 13.10.2022 I WANT TO INVEST WITH INTERACTIVE BROKERS

Swing: –

–

Summary for the session

Intraday: 13/10

Chance for major move to noon: Further declines (sustained)

Session target: 12,030 – 11,972 points (sustained)

Confirmation behind the thesis: Strictly downward structure (upheld)

Today’s PK * levels:

R3 = 12,891

R2 = 12,743

R1 = 12,597

PK = 12,460

S1 = 12.307

S2 = 12.168

S3 = 12,031

Swing: * Directional point – a subjectively determined critical level for the index. Although the structure may resemble pivots, in practice it is nothing more than hand-marked intraday trading zones. You can learn more about the waypoints in the periodic webinar meeting – “Setting Waypoints in Practice”. All cycle analyzes can be tracked under the tag PSV. Also learn about the PSV methodology – described here.

Maksymilian Bączkowski also recommends:

RISK NOTE:

The article is sponsored by Interactive Brokers CE. Interactive Brokers Central Europe Zrt. (IBCE) is regulated by the MNB. IBCE is not responsible for the content of this article. Investing comes with the risk of losing your capital. Some financial products are not suitable for all investors. Clients should read the relevant risk warnings before investing. Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>