The year 2022 was a big challenge for cryptocurrency exchanges. As Warren Buffett said, it’s only when the tide goes out that you find out who’s swimming naked. In a volatile market, FTX, an exchange worth billions of dollars, was instantly knocked out of the market, with far fewer medium and small exchanges likely to suffer the same consequences. Many investors were not even able to recover their assets stored in brokerages. Meanwhile, the crypto community discusses how to make centralized exchanges more regulated and transparent.

Regulators sound tough regulatory signals

After the FTX collapse, most traditional financial regulators put cryptocurrencies on their radar. The Vice Chairman of the Fed, the Chairman of the SEC, the US Treasury Secretary, the Deputy Governor of the Bank of England and the International Monetary Fund have all proposed imposing effective regulatory oversight on cryptocurrencies; the market must follow the same rules as the traditional financial sector to mitigate risks. Of the existing cryptocurrency exchanges, Coinbase is the biggest supporter of strong regulatory oversight. Coinbase CEO Brian Armstrong stated that the regulations discussed by lawmakers around the world will help them defeat competitors. Furthermore, the exchange has also published Regulating Cryptocurrencies: How We Move The Industry From Here in December 2022, which outlines how the industry can be regulated in terms of stablecoins, trading platforms and custodians. Cryptocurrency regulatory intervention is clearly inevitable after the FTX crash. That said, in 2022, the Tornado Cash privacy protocol was sanctioned by OFAC (US Agency for Foreign Assets Control) and led to resistance to regulations in the crypto community. After all, sanctions are not what we want to see in a market that seeks decentralization. Furthermore, prior to its downfall, FTX also embraced regulation, but it turned out that it was just a stance that allowed the exchange to seek publicity and crush the competition. Based on the attitudes of major exchanges, we can say that regulations will become stricter in certain countries, but many are not convinced of their validity. In conventional finance, it is common for a large corporation to fail, and strict regulations do not eliminate all risk. Meanwhile, what happened to Tornado Cash is always a reminder that regulations come with sanctions. Once regulators start stepping in with tough measures, many innovative decentralized applications will be strangled in their cradles, and some investors may not have access to the market due to regulatory oversight.

The industry is seeking transparency

After the crisis of confidence due to the collapse of the FTX, exchanges published the Merkle Tree and the addresses of its proof of reserve. For example, major trading platforms like Binance, OKX, Crypto.com, Huobi and CoinEx released their proofs of reserve shortly after the FTX crash. According to disclosed wallet addresses and user assets, these exchanges have managed to achieve 100% reserve coverage of assets, and some exchanges have reserve funds that far exceed investors’ assets. For example, Binance and CoinEx USDC reserve fees are above 400%.

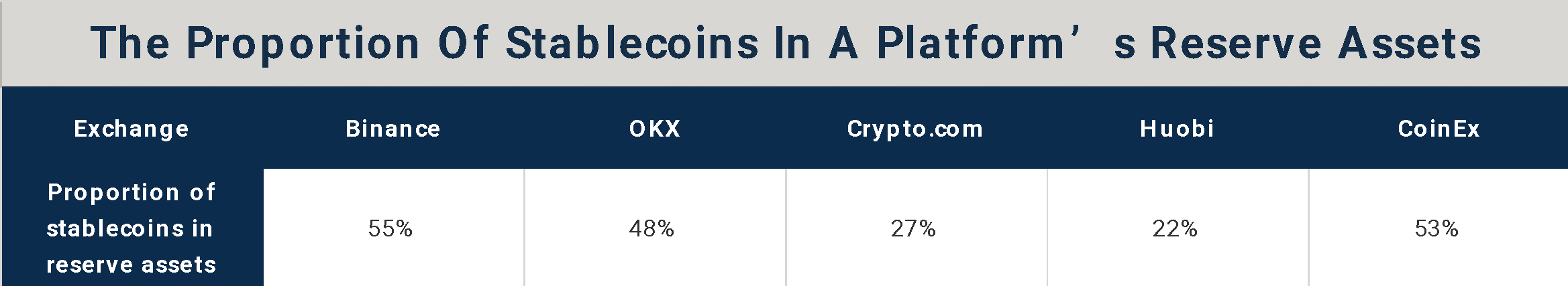

Many people argue that having a 100% reserve fee is great because it ensures that users can always withdraw their cryptocurrency. While this statement is not 100% accurate, given current market conditions, proofs of reserve are the best way to make cryptocurrency exchanges more transparent. In addition, the broker’s reserve assets are also indicative of the platform’s operation. For example, we all know that stablecoins need to process bulk withdrawal requests when there is a run, which means that the proportion of stablecoins in the reserve assets of a platform can roughly tell us the risk resilience of different platforms in extreme scenarios. As can be seen from the table below, on Binance and CoinEx, the ratio of stablecoins to reserve assets is over 50%, which means that stablecoin withdrawals can always be processed. It should be noted, however, that 52% of Binance’s stablecoin reserves are BUSD, a coin issued by the exchange itself. Although BUSD has gained issuance approvals, some still worry that it could be withdrawn if Binance crashes. Therefore, investors must assess the risks on their own before choosing an exchange.

In line with the stated attitude of cryptocurrency exchanges, most platforms prefer to gain user trust through high transparency. While some players argue that reserve assets are not unambiguous evidence of a platform’s security, compared to strict regulation, reserve proofs are obviously more popular with users. Furthermore, over time, proof-of-reservation technologies will also advance in response to market demands. After the collapse of FTX, the crypto industry has shifted its focus to security and transparency, which will bring about new development trends. Meanwhile, centralized exchanges will become more transparent in facilitating transactions, and decentralized asset management on centralized platforms may even gain traction. As such, investors still need to look to platforms based on long-established technology. A good example is CoinEx mentioned above. Backed by a 100% proven reserve rate and sufficient reserve assets, the broker offers strong guarantees in terms of assets and technology.

Notice: this article is for informational purposes only, it does not constitute investment advice or an offer to invest. CriptoFácil is not responsible for any content, products or services mentioned in this article Read also: Focus on the Future: 5th CoinEx Celebration comes to an end Read also: Build your sequence of great leagues and win incredible prizes at 1xBit Read also: Proof of Reservation : CoinEx launches trust system that guarantees the security of assets