While at the beginning of 2022 the prices of the vast majority of cryptocurrencies were either consolidating or noticeably depreciating, Terra (LUNA) managed to overcome the falls in February and joined the March rebound, reaching its latest ATH around $ 103.88. Where does such a good behavior of the project come from and how will the cryptocurrency prices behave in the near future?

LUNA is currently hovering around $ 90 and its price is receding from its recent high

Cryptocurrency set a new all-time record on March 9, breaking the USD 101 mark

Although a large number of investors have realized their profits in recent days, the long-term forecasts of the token’s price remain bullish

The original article was prepared by Capital.com analysts, and all its content is available here

Terra surprises again

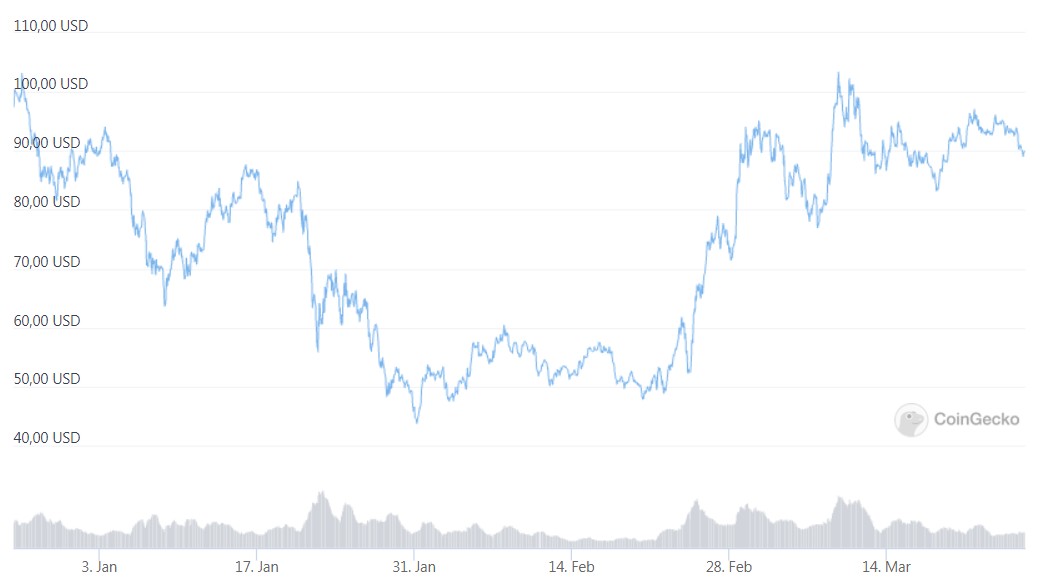

Terra (LUNA) established its new ATH on March 9, reaching a valuation of $ 103.88. The previous peak was set in December 2021 at $ 99.5, which means the cryptocurrency has had a spectacular half-year behind it. Currently, however, the token price is moving more than 13% below the recently established high, and its quotes are rebounding some of the gains. In early 2022, the price of the LUNA coin dropped drastically and on January 31 it reached its 30-day low of $ 43.57. February heralded a sharp change and a sudden appreciation, thanks to which the cryptocurrency regained the level of $ 91 on March 1.

LUNA / USD Source CoinGecko In the first half of March, an analyst using the pseudonym Kaleo tweeted that if LUNA soon broke the USD 104 mark, then it could expect an increase of at least 70%.

LUNA / USD Source CoinGecko In the first half of March, an analyst using the pseudonym Kaleo tweeted that if LUNA soon broke the USD 104 mark, then it could expect an increase of at least 70%.

LUNA / BTC pair is already in price discovery. After 2+ months of accumulation to get there, I’d be shocked if a 25% pump is all we see pic.twitter.com/hMD1ETb6Cz

– KALEO (@CryptoKaleo) March 14, 2022

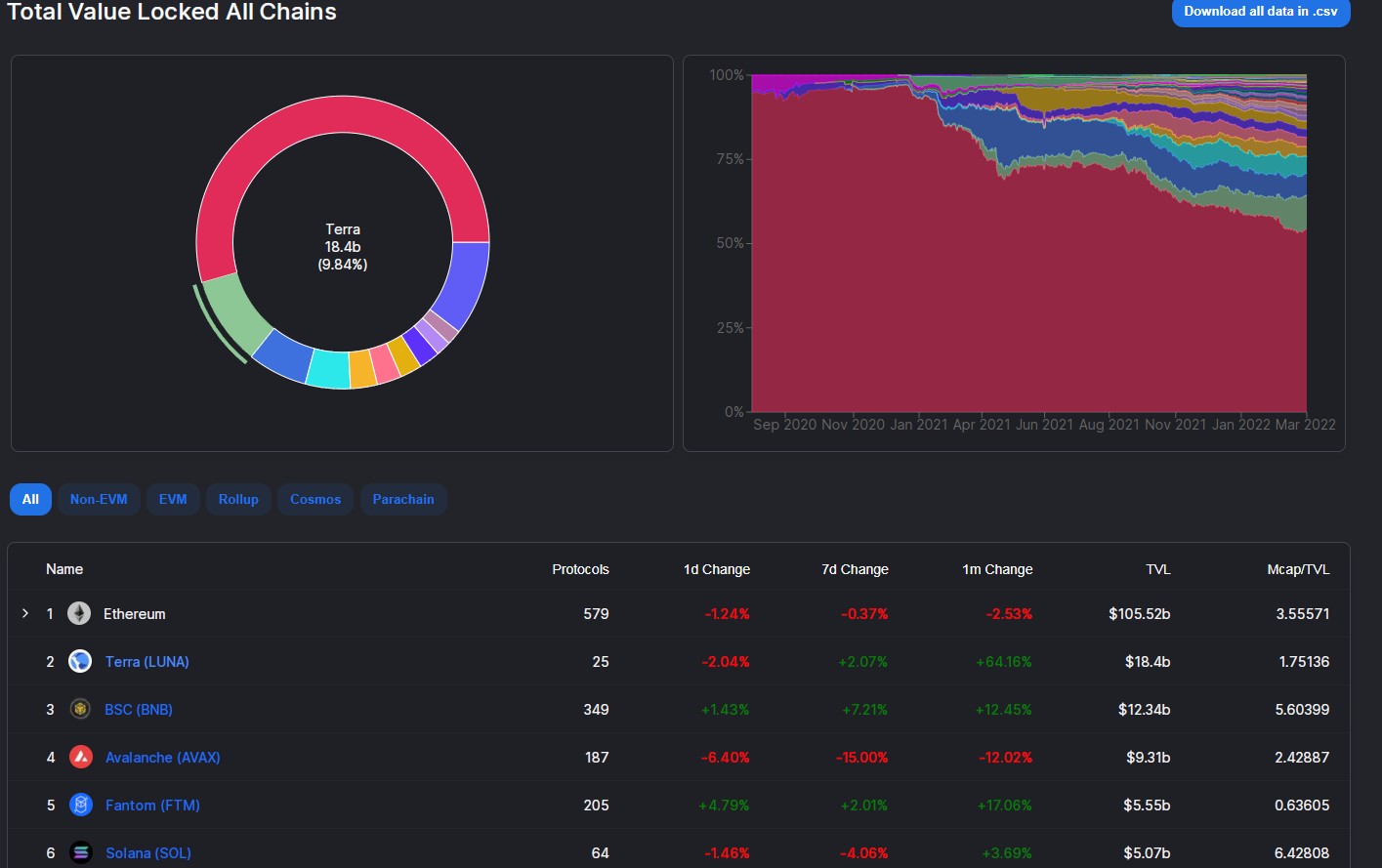

– LUNA is still one of the bullish coins and is still in a long term growth structure in my opinion. Personally, I would rather shortcut other things than this, ‘added Kaleo. Good stock performance correlates with the exponential growth of its ecosystem. DeFiLlama’s decentralized finance network tracker indicates that the total locked value (TVL) of the cryptocurrency has already exceeded $ 18 billion, an increase of over 50% over the past month.

The TVL represents the total capital held in smart contracts and is calculated by multiplying the amount of collateral locked in the network by the present value of the asset. This means that Terra is currently the second largest blockchain in terms of total locked value behind Ethereum (ETH) and ninth in terms of total market capitalization.

TerraUSD is a key element of the ecosystem

Terra is also an independent payment-focused financial ecosystem powered by algorithmic and scalable stablecoins linked to fiat currencies. Belonging to the TerraUSD (UST) network, it is one of the largest stablecoins in the world, and it is no coincidence that it is tied to the US dollar. Unlike other decentralized token stablecoins, Terra uses a flexible monetary policy, ensuring price stability and an appropriate growth rate, using a similar mechanism to that by central banks. In order to maintain stability, TerraUSD is based on classic market mechanisms. When the value of one UST is below $ 1, users can limit the supply by smoking UST to get the LUNA cryptocurrency equivalent. Conversely, when the value of one UST exceeds $ 1, they can burn a quantity of LUNA equivalent to $ 1, thereby obtaining UST 1. The LUNA token also serves as a tool to reduce volatility. When the demand for Terra currencies increases, the system extracts them and in return takes LUNA and then burns some of the LUNA earned. As a result, the supply is decreasing. Furthermore, LUNA stakeholders earn from protocol-billed transaction fees because LUNA is used to validate Terra transactions.

Price forecasts

Short-term sentiment remains neutral, with 16 bullish and 9 bearish indicators, according to CoinCodex’s technical analysis. The overwhelming majority of Daily and Weekly Simple Moving Averages (SMAs) and Exponential Moving Averages (EMAs) as well as the Volume Weighted Moving Average (VWMAs) give signals to buy. On the other hand, the Hull Moving Average (HMA) and Average Directional Indicator (ADX) send bearish signals. On the other hand, the Williams index, MACD and the Relative Strength Index (RSI) remain neutral.

However, the short-term terra price forecast from CoinCodex suggests that Luna could drop to $ 66 by the end of the month. According to Wallet Investor’s forecast, the average coin price could reach $ 183.3 in the next 12 months. The five-year terra forecast for LUNA / USD indicates that it could reach $ 539 as early as March 2027. The LUNA price forecast from Digital Coin suggests that the average price in 2022 could be $ 121.31, rising to $ 142 in 2023, then $ 180 in 2025 and $ 425 in 2030. Likewise, Price Prediction estimated that the average LUNA coin price could reach $ 120.6 in 2022, $ 381 in 2025 and $ 2,541 in 2030, respectively. However, whatever forecasts it is, it’s important to note that the cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what the price of a coin will be over the course of a few hours, and even more difficult to make long-term estimates. Therefore, it should be borne in mind that analysts can be wrong in their forecasts. We recommend that you always do your own research and take the latest market trends, news, technical and fundamental analysis and expert opinions into account before making any investment decision. You should never invest more than you can afford to lose. The rest of the article can be found here OPEN AN ACCOUNT AT CAPITAL.COM AND TRADE IN CRYPTOCURRENCIES

The author also recommends:

Follow us on Google News. Search what is important and stay up to date with the market! Watch us >>