It is another consecutive week of decline on the stock exchanges, the sell-offs of which did not end with some positive information about the current state of the economy. US stock markets were not very volatile and continued the downward trend as investors absorbed the inflation data and the first important reports on company results for the second quarter.

Analysis of EUR / USD, S&P 500, and other relevant markets

On Thursday morning, the S&P 500 index reached its lowest level since June 22. Friday’s equity rally following a solid US monthly retail sales report was not enough to offset the difficult start of the week on the equity market. So the main US indices recorded slight losses, falling for the 12th week from the last 15. Technology stocks performed the best in the index, which was supported by the sharp rise in Apple’s stock. Energy equities were weaker as international oil prices dropped to levels unseen since Russia’s invasion of Ukraine. Equities in Europe ended the week with slight declines as central banks sped up interest rate hikes, heightening fears of a global recession. In the five days ended July 15, the pan-European STOXX Europe 600 Index fell by 0.80%, while the German DAX index retreated by 1.16%, the French CAC 40 gained 0.05% and the Italian FTSE MIB fell by 3. 86%. The British FTSE 100 index fell 0.52%. The bond yields of the eurozone countries have declined amid mounting concerns that cutting off Russian gas could put European economies into recession.

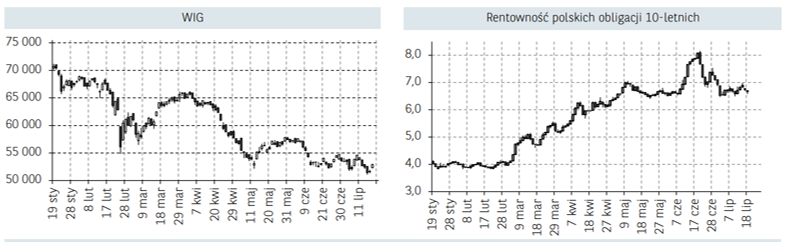

As a result, the markets lowered expectations for a monetary tightening, which resulted in an increase in demand for government bonds. UK government bond yields followed core markets. Italian 10Y bond yields have fallen along with bonds since the beginning of the week, but then rose after the collapse of the Italian ruling coalition. The yield on 2-year US treasury bonds remained above the yield on 10-year bonds, and this difference deepened as the week went on – on Friday the yield on 2-year bonds was around 3.13%, and the yield on 10-year bonds was 2.93%. the so-called a yield curve reversal is often seen as a sign that economic trouble is just around the corner as past reversals have often been preceded by recessions. The euro fell below parity with the US dollar for the first time in two decades as fears of a global recession intensified. Bank of France governor Francois Villeroy de Galhau told franceinfo that the European Central Bank is monitoring the fall of the euro because of its impact on inflation. He also suggested that the movement in the currency pair is not necessarily due to the fundamentals of the euro. “When we look at what has happened since the beginning of the year, it is not so much the euro that is weak,” he noted, “but the dollar is strong, especially because it has traditionally been a safe haven.” The Polish stock exchange recorded further sell-offs and recorded a lower level than at the end of the previous week at 1620 points on the WIG20. This level means breaking the lows from June this year. Important for investors was the information provided by the authorities about the possibility of sharing profits with the public by State Treasury companies and signing the law on credit holidays, which significantly influenced the valuation of banks.

After dropping briefly below $ 100 a barrel in the previous week, US crude oil fell further below this threshold and stayed there as concerns about recession impacted energy demand. Oil hovered around $ 98 on Friday, falling from its recent high of $ 122 on June 8.

Information on the investment fund market

Last week was unsuccessful for the vast majority of types of mutual funds. The funds which provided exposure to the Polish stock market were the worst performers, which lost 2.99% on average. Within this category, universal Polish equity funds fared the worst, as they lost 3.42%, which corresponded to the minor sentiment on the Polish stock market. A comparable discount was also recorded by funds based on commodity markets, which fell by 2.87%. In the context of the spectrum of this solution, the solutions giving exposure to the precious metals markets (-2.73%) were the most heavily burdened, which was a consequence of declines in the gold and silver markets. Funds based on the Polish debt market lost 0.22% on average, which is a derivative of lower volatility on the Polish debt market than that observed in June. In the context of this category, funds based on Polish long-term Treasury bonds lost the most, which fell by 0.49%. The solutions based on universal Polish debt securities performed relatively better with a loss of 0.07%.

Macroeconomic situation – Poland and the world

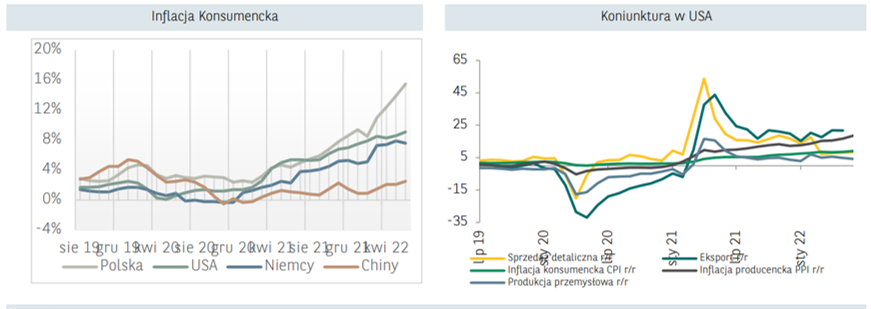

Last week was another period that provided mixed macroeconomic signals around the world. After an annual rate increase to 8.6% in May, the consumer price index further accelerated to 9.1% in June, the highest level since November 1981. Excluding volatile energy and food prices, core inflation increased by 0.7% m / m, compared to 0.6% in the previous two months. The value of inflation was above the consensus expected by the market. US retail sales rose in June by 1.0% MoM, slightly above expectations, despite rising inflation and recently weak consumer sentiment readings. However, the increase in sales that the government released on Friday has not been adjusted for inflation, which rose 1.3% in June, indicating that real sales were slightly negative. However, the given increase in sales was not adjusted for inflation, which was higher (1.3% MoM) than nominal sales (1.0% MoM), which means that real sales were slightly negative. With US annual inflation currently at 9.1%, policymakers are under pressure to approve another large interest rate hike to the US Federal Reserve meeting next week. At its mid-June meeting, the Fed raised its short-term target range by three-quarters of a percentage point – the largest hike since 1994 – and a similar sharp hike is expected at the upcoming meeting, with some economists expecting rates to go up by as much as a full percentage point .

The Chinese government said the country’s GDP grew by 0.4% in the second quarter, the weakest annual growth since the start of the pandemic. The recent COVID-19 blockades in major Chinese cities have resulted in slower growth rates. The European Commission lowered its economic outlook for Europe and raised its inflation outlook due to the continued negative impact of Russia’s invasion of Ukraine. According to the summer forecasts, Gross Domestic Product (GDP) in 2022 will remain unchanged at 2.7%, but in 2023 it is expected to slow down sharply to 1.5% and not to 2.3%, as previously forecasted . Inflation is projected to rise to 8.3% in 2022, compared to the previous forecast of 6.8%. The rate for 2023 was also raised to 4.6% from 3.2%. A number of Polish data will be released this week. On Wednesday, the CSO will publish data from the Polish labor market. In June, we expect wage growth to slow down again, this time to 12.5%. In our opinion, industrial output growth rose by 11.5% y / y in June, slightly slower than in May. In the face of signs of weakening demand, we expect that retail sales dynamics (in constant prices) slowed down to 7.2% from 8.2% y / y in May. Globally, the markets’ attention will focus on Thursday’s ECB meeting. According to previous statements, the president of Christine Lagarde at the July meeting the Council will decide on the first increase in the deposit rate from -0.5% to -0.25% in eleven years. During the conference, the markets will probably look for information on future ECB decisions. Previously, Lagarde pointed out that the September decision will be strongly dependent on the economic situation in the euro zone. The week on the market will close with the publication of preliminary PMI estimates for the world’s largest economies. The June estimates surprised negatively, pointing to a strong slowdown in activity in both industry and services. In July, the declines probably deepened.

The author also recommends:

See other phrases searched most frequently today: cd projekt marketplace | amica stocks buy | current dollar rate | comarch stock exchange | jsw shares | lotus shares recommendations | oil at wti rate | Follow us on Google News. Search for what’s important and stay up to date with the market! Watch us >>