The European indices ended the last trading day above the mark this week. On the spot market, the DAX gained 0.72% today, while the WIG20 and FTSE100 gained 0.35% and 1.19%, respectively. In Poland, investors learned about a number of data from the economy. Their tone does not show a very optimistic picture and may indicate that the inflation peak is still ahead of us. Wages are rising by as much as 14.1% YoY against expectations of 12.6% YoY and at the previous level of 12.4%.

Gold remains above $ 1,840 an ounce

Industrial production is a negative surprise. Growth at the level of 13% y / y, with the expectation of an increase of 16.1% y / y and with the previous reading of 17.3% y / y. Producer inflation is rising. In this case, we have an increase of 23.3% y / y. 20.4% y / y was expected and previously it was 20.0% y / y. Negative sentiment prevails on Wall Street. All indices except the Russell 2000 have dropped below their most recent lows and are currently trading levels not seen since November 2020. S & P500 index. Additional pressure on the valuation of shares has been put by Monkey Pox, which is beginning to spread in Europe. However, fears of a rebound of the global pandemic seem to be far premature, although the news fell on ‘fertile ground’ as the panic wave sweeps across global markets. WHO has decided to convene an extraordinary meeting on this matter. JPY and GBP are the best performing major currencies while AUD and EUR remain the weakest. Gold benefited from the downturn in sentiment and the precious metal is now trading at $ 1,845, while silver is down to $ 21.66. The sell-off of US indices put pressure on cryptocurrency valuations. Bitcoin returned below the $ 29,000 mark and Ethereum fell below the $ 1,940 barrier. The PBoC has significantly cut its benchmark mortgage rate, the second cut this year. The world’s second-largest economy is looking to revive the housing market to support a slowing economy hit by recent blockades

World indices started today’s session in optimistic moods after information that China lowered its benchmark mortgage rate to support the economy hit by the recent locks. Moods began to worsen before the end of the European session, however, partly due to reports of new cases of monkey pox in Europe. Wall Street turned the rally into a sale, reversing previous gains. The Dow Jones and S & P500 fell to their lowest level since March 2021, while the Nasdaq is trading at levels not seen since November 2020 as investors remain most concerned about a recession or stagflation scenario and no action by the Fed to contain further declines.

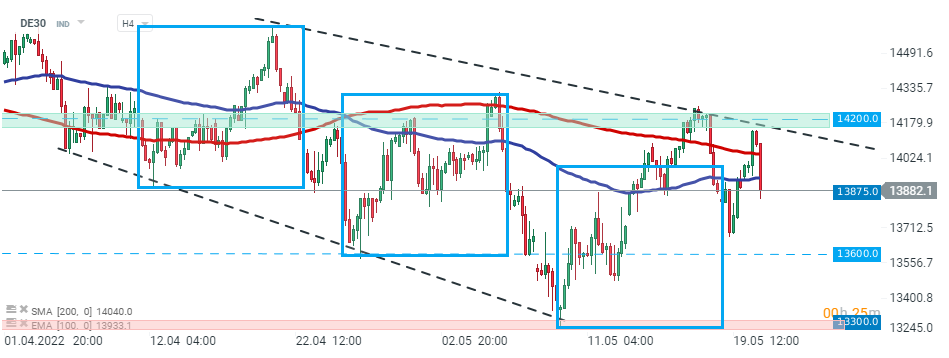

DE30 rate Source: xStation5 This week the DE30 rate broke above the upper limit of the structure 1: 1, but buyers twice failed to break above the upper limit of the wedge formation around the resistance at 14,200 points. As long as the price is below this level, the bears remain in control. The DE30 resumed its downward move in the evening amid a wide market sell-off and is currently testing local support at 13,875 points, which coincides with a 50.0% retracement of the Fibonacci uptrend launched in November 2020.

DE30 rate Source: xStation5 This week the DE30 rate broke above the upper limit of the structure 1: 1, but buyers twice failed to break above the upper limit of the wedge formation around the resistance at 14,200 points. As long as the price is below this level, the bears remain in control. The DE30 resumed its downward move in the evening amid a wide market sell-off and is currently testing local support at 13,875 points, which coincides with a 50.0% retracement of the Fibonacci uptrend launched in November 2020.

The author also recommends:

Follow us on Google News. Search what is important and stay up to date with the market! Watch us >>