Warren Buffett Coca-Cola Co. at the time of its debut on the New York Stock Exchange in 1965, it had a market capitalization of only $8.3 million. Today, the soda maker is valued at nearly $700 billion, an increase of roughly 10 million percent. Berkshire Hathaway first began buying Coca-Cola stock in 1988 and has been collecting stocks ever since.

Coca-Cola is the perfect example of a Buffett-style long-term investment

In 1988 when Buffett started buying Coke shares, they cost a few dollars apieceso Berkshire Hathaway now has a huge profit on that company. Coke also pays a dividend of 44 cents every quarter, so the investor earns nearly $1 billion a year in dividends. Currently, Berkshire Hathaway owns 400 million shares of Coca-Cola worth $22 billion, or about 8% of the entire company.

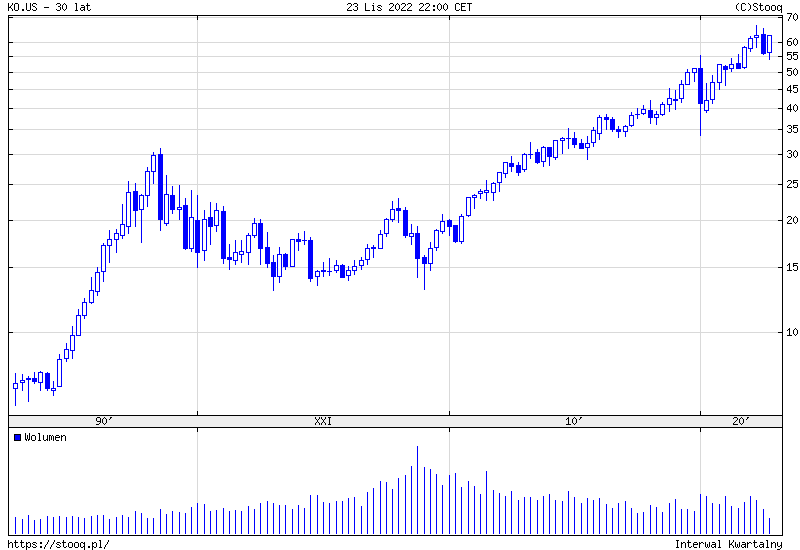

Coca-Cola Co (KO.US) Buffett likes Coca-Cola stock for the same reason he likes every company he invests in, which is value. Which has two meanings. Firstly, he is known to only invest when the price is right and not a penny more. Coca-Cola stock, at the time, was well priced with an interesting competitive advantage. Coca-Cola holds nearly 50% of the US soft drink market, so as long as people drink soft drinks, Cola will do well. Second, and perhaps more importantly, Coca-Cola creates value. Buffett likes “productive assets” that produce cash and produce product. The legendary investor stayed away from things like cryptocurrencies because they don’t produce anything.

Coca-Cola Co (KO.US) Buffett likes Coca-Cola stock for the same reason he likes every company he invests in, which is value. Which has two meanings. Firstly, he is known to only invest when the price is right and not a penny more. Coca-Cola stock, at the time, was well priced with an interesting competitive advantage. Coca-Cola holds nearly 50% of the US soft drink market, so as long as people drink soft drinks, Cola will do well. Second, and perhaps more importantly, Coca-Cola creates value. Buffett likes “productive assets” that produce cash and produce product. The legendary investor stayed away from things like cryptocurrencies because they don’t produce anything.

Why won’t Buffett sell Coca-Cola?

Buffett has previously mentioned Coca-Cola in this sense. He noticed how Coca-Cola produces nearly 2 billion drinks a day. So if the company wants to make more profits, it can raise the price of its beverages by as little as 1 cent per serving and thus make an additional $20 million a day. Such stocks are Buffett’s bread and butter, and he still likes Coca-Cola stocks as much as the day he bought them. Coca-Cola has maintained its dominance in the market for decades, and as long as it maintains it, Buffett is unlikely to sell Coca-Cola shares. While Cola’s stock is unlikely to earn that much again given its size, there are still valuable and well-valued businesses in the industry.

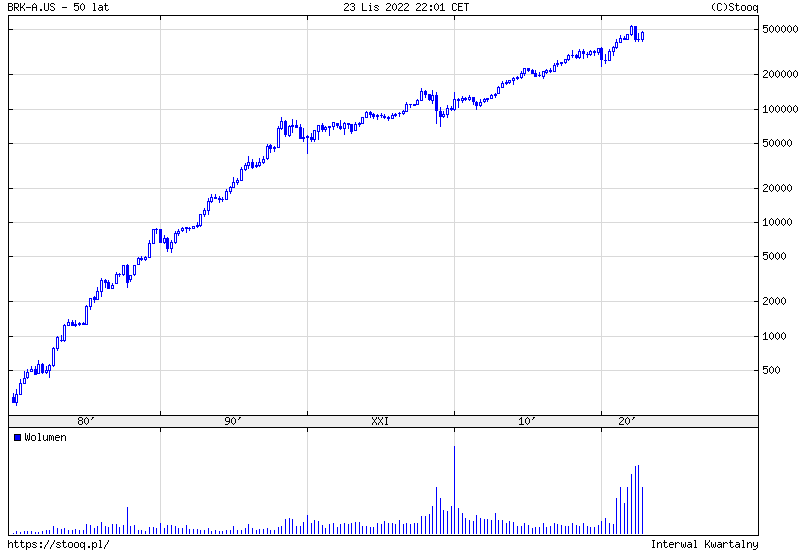

Berkshire Hathaway Inc (BRK-A.US) Warren Buffett, also known as the “Oracle of Omaha”, is widely regarded as one of the greatest investors of all time. The legendary investor through Berkshire Hathaway has brought tens of thousands of percent profit over the years and consistently beats the broad market

Berkshire Hathaway Inc (BRK-A.US) Warren Buffett, also known as the “Oracle of Omaha”, is widely regarded as one of the greatest investors of all time. The legendary investor through Berkshire Hathaway has brought tens of thousands of percent profit over the years and consistently beats the broad market

The author also recommends:

Follow us on Google News. Search for what is important and stay up to date with the market! Follow us >>