A few years ago, Ethereum (ETH) launched the Beacon Chain, a different Proof of Work (PoS) network. Until then, Ethereum used the same type of consensus mechanism to maintain its blockchain as Bitcoin — Proof of Work (PoW). Beacon introduced a new way to add blocks of data to the chain, staking. From September 15 to 16, 2022, Ethereum will become a PoS network when Beacon merges with its main network. The move will abandon miners and computational work in favor of staking and economic validators. Here is a primer explaining what this means for decentralized finance:

Why is Ethereum important?

While Bitcoin legitimized the concept of peer-to-peer (P2P) digital money, it was Ethereum that spearheaded the next step in blockchain – smart contracts that deploy decentralized applications (dApps). Bitcoin represents around 40% of the total cryptocurrency market cap. But it was Ethereum that extended smart contracts to many uses – lending, predictive markets, NFT markets, exchanges, gaming, governance, wallets, storage, and even gambling. The total amount locked (TVL) on Ethereum multiplied almost 12 times to around BRL 570 billion ($110.6 billion) between November 2020 and November 2021. Clearly, dApps were in high demand. And this increase has expanded the capacity of Ethereum.

Ethereum’s proof-of-work scalability issue

Both Bitcoin and Ethereum were launched as PoW systems that added new blocks of data to a blockchain through expensive computational work. Under PoW, blockchain networks are less vulnerable to hacking. But the consensus mechanism uses huge amounts of electricity. That’s because miners have to rush to solve the math problems first and earn the right to add blocks to the chain. This means employing vast server farms. However, PoW demonstrated that blockchains can be immutable. Without this immutability, Bitcoin would not have been sustainable and would have been useless. The difference between the utility of Bitcoin and Ethereum is clearly visible when we compare their daily transactions. Despite having twice the market cap of Ethereum, Bitcoin has more than five times the number of transactions.

Source: The Block However, if Ethereum goes to the mass market, its energy expenditure would become impractical. This is the main reason why Ethereum is transitioning from PoW to PoS. By making this change, the Ethereum Foundation estimates that the network’s energy footprint will decrease by ~99.95%. But there are many other benefits as well.

What exactly is The Merge?

In December 2020, Ethereum launched the Beacon Chain.

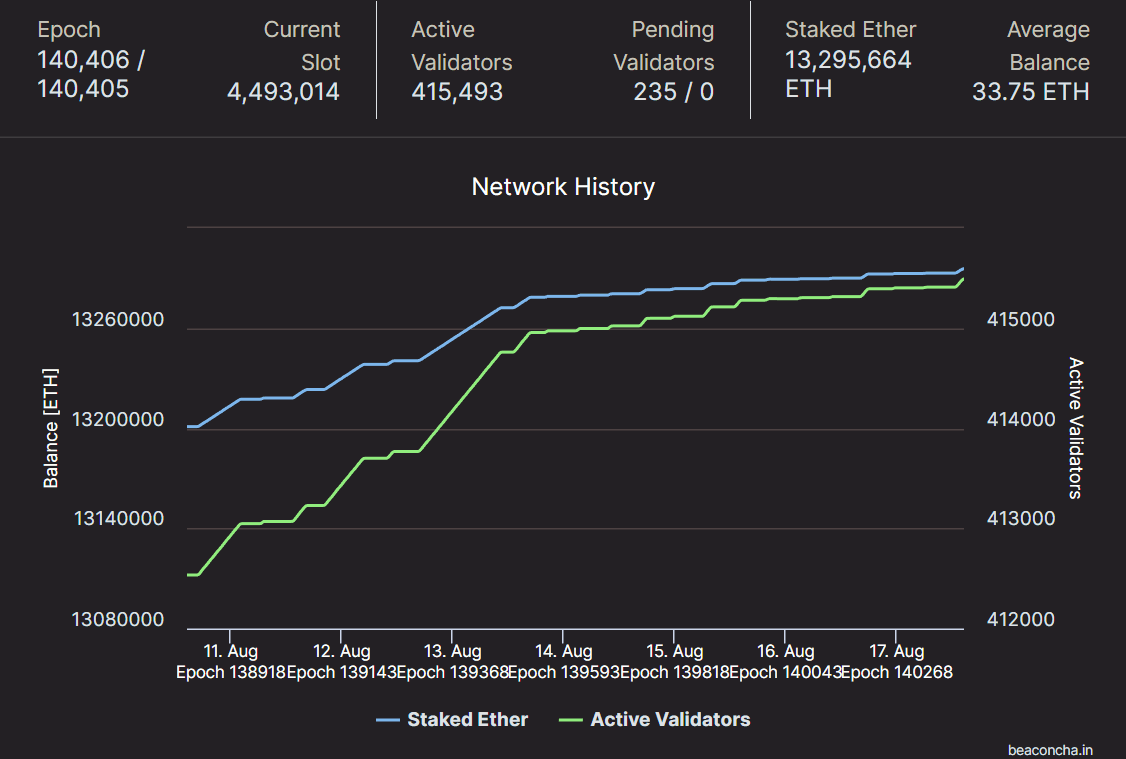

Source: Beaconcha.in Beacon operated like other PoS networks, such as Algorand, Avalanche, Cardano or Solana, for example. Validators run software that turns your computers into blockchain network nodes. Each node is responsible for storing the entire copy of the ledger, processing transactions and adding them to the blockchain. In return, validators receive rewards in ETH. Unlike Bitcoin miners, validators use a fraction of the energy to execute and add new blocks of data. When it comes to the requirement to be a validator, a common misconception is that they need a minimum of 32 ETH in staking (“locked in”). After all, this only applies to nodes that propose the next blocks to be added. Most Ethereum validators, however, run non-block generator nodes, via a staking pool. As Vitalik Buterin explicitly stated, a low barrier to entry is the key to keeping Ethereum decentralized. That’s because the more nodes there are, each containing the complete copy of the ledger, the greater the redundancy.

Source: Beaconcha.in Beacon operated like other PoS networks, such as Algorand, Avalanche, Cardano or Solana, for example. Validators run software that turns your computers into blockchain network nodes. Each node is responsible for storing the entire copy of the ledger, processing transactions and adding them to the blockchain. In return, validators receive rewards in ETH. Unlike Bitcoin miners, validators use a fraction of the energy to execute and add new blocks of data. When it comes to the requirement to be a validator, a common misconception is that they need a minimum of 32 ETH in staking (“locked in”). After all, this only applies to nodes that propose the next blocks to be added. Most Ethereum validators, however, run non-block generator nodes, via a staking pool. As Vitalik Buterin explicitly stated, a low barrier to entry is the key to keeping Ethereum decentralized. That’s because the more nodes there are, each containing the complete copy of the ledger, the greater the redundancy.

Expected impacts of The Merge

There is confusion about what will and won’t happen after The Merge. Here are some of the most common misconceptions:

Will ETH gas rates decrease?

Contrary to popular belief, The Merge will not significantly affect ETH gas rates. Whenever a network’s traffic load is high, the fees increase because there are only a limited number of transactions that the Ethereum network can process. As The Merge is not focused on scalability, but on staking itself, this will not change. Currently, Ethereum can process up to 15 transactions per second (tps). This will not change significantly after the event. At best, there can be a single-digit percentage increase in tps due to reduced block times, from 13.3 seconds to 12 seconds. An average block time is the time it takes to add a new block of data (transaction) to the blockchain. In order for a more significant tps increase to occur, Ethereum must undergo sharding, which is the next scheduled update, called The Surge, which should occur sometime between late 2023 or 2024. The sharding will split the network into chunks . In this way, the network load will be more evenly distributed. Meanwhile, Ethereum will rely on Layer 2 scalability networks such as Polygon, Optimism, Arbitrum and others for a low-gas rate experience.

What about staking rewards?

All validators who have locked their ETH on the Beacon Chain will have to wait a little longer after The Merge to withdraw the funds. Specifically, this will happen after the Shanghai update, which is scheduled to start about a year after The Merge. In addition to unlocking staking ETH by activating EIP-4895, the Shanghai update will introduce a new type of smart contract, the EVM Object Format (EOF). It will further expand Ethereum’s smart contract functionality. Also, validators running block bidder nodes will only be able to partially withdraw their ETH, leaving behind the required minimum of 32 ETH. Naturally, this cap was put in place to prevent a mass exodus of validators. After all, otherwise the security of the network would be at risk. Finally, as validators are more efficient at processing transactions, the annual percentage rate (APR) is likely to increase from ~4% to ~7%. Receiving native token rewards to validate transactions is at the heart of every decentralized blockchain network. On the one hand, traders pay the transfer fees and on the other hand, validators receive them. That way, there is no need for an accounting department. This is because this incentive structure is automated through smart contracts. Of course, the more users become active, the more fees validators receive.

Changing Tokenomics ETH

Another important aspect of The Merge is how it will change the ETH inflation rate. Each blockchain network has its own inflation control mechanism. For example, Bitcoin has halving events that reduce mining rewards, meaning fewer Bitcoins are released into the circulating supply. Since its launch, Bitcoin has had three halvings, going from 50 BTC mining rewards to 6.25 BTC. With a lower inflow of new Bitcoins, each one values more due to the law of supply and demand. In the case of Ethereum, it does not have a limited supply of coins like Bitcoin or even other PoS networks like Avalanche. Instead, Ethereum has an inflation rate of around 13,400 ETH or 4.2%.

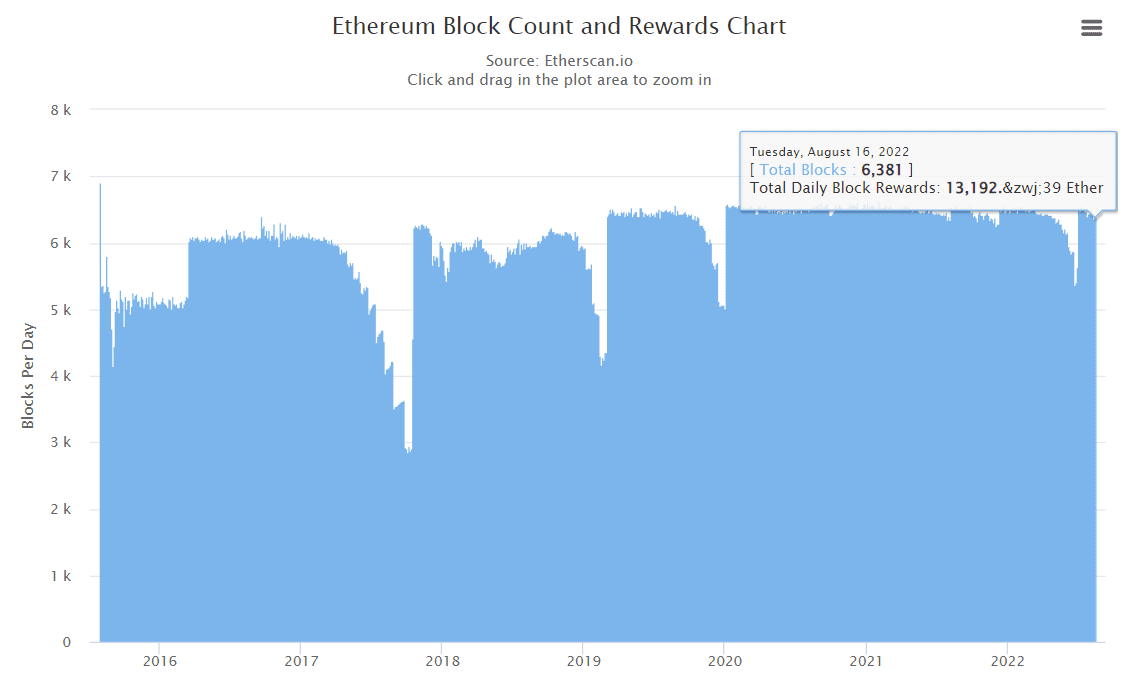

Source: EtherScan.io After The Merge, ETH issuance is expected to drop to around 0.2%, which equates to Bitcoin’s “triple-halving”. Combined with the anti-inflationary pressure coming from burning base rates (introduced with EIP-1559), this translates to a much larger increase in demand over supply. In August 2022, $4.7 billion worth of ETH was burned, i.e. sent to a dead wallet.

Source: EtherScan.io After The Merge, ETH issuance is expected to drop to around 0.2%, which equates to Bitcoin’s “triple-halving”. Combined with the anti-inflationary pressure coming from burning base rates (introduced with EIP-1559), this translates to a much larger increase in demand over supply. In August 2022, $4.7 billion worth of ETH was burned, i.e. sent to a dead wallet.

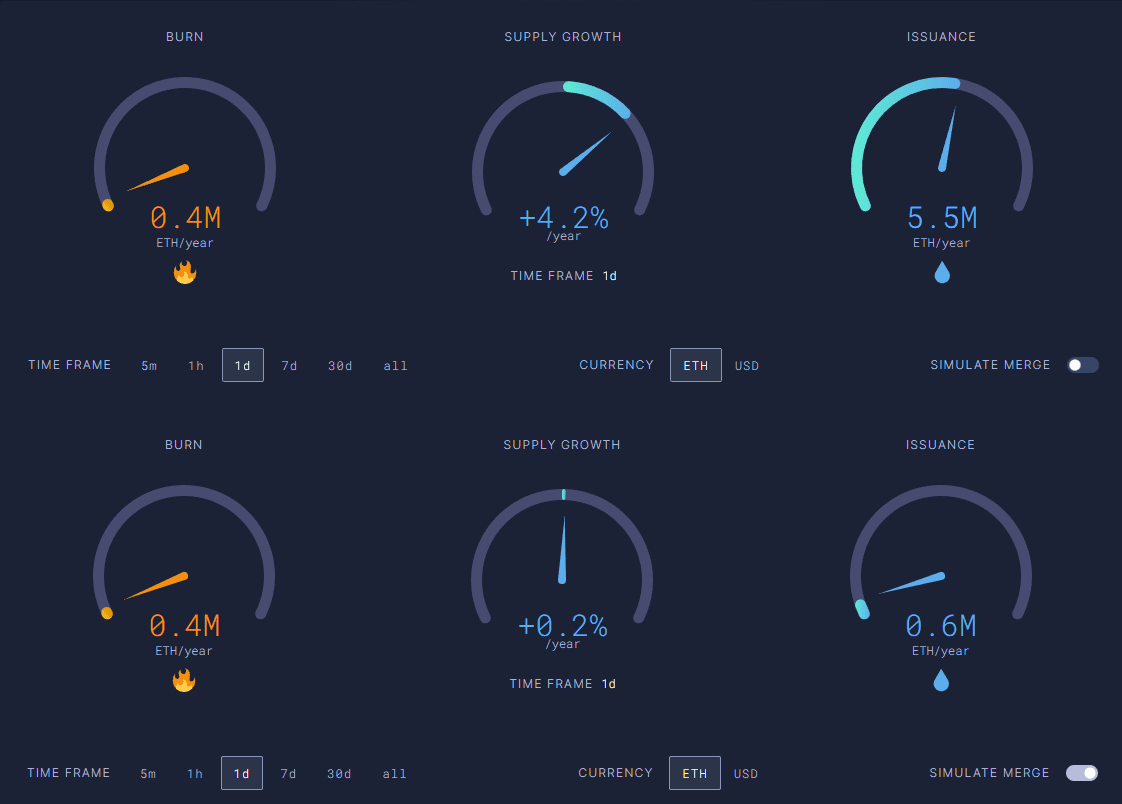

The top represents Ethereum’s pre-Merge tokenomics, while the bottom simulates its post-Merge tokenomics. Source: ultrason.money The reason for Ethereum’s lower inflation rate is directly linked to the higher energy efficiency of PoS. So, validators will need less ETH rewards after The Merge. Overall, having an inflation rate below 1% should positively impact the price of ETH, especially if greater utility is added to the mix. In conclusion, the event should result in the following impact on ETH price: More utility + reduced ETH issuance + burning = higher demand → higher ETH price.

The top represents Ethereum’s pre-Merge tokenomics, while the bottom simulates its post-Merge tokenomics. Source: ultrason.money The reason for Ethereum’s lower inflation rate is directly linked to the higher energy efficiency of PoS. So, validators will need less ETH rewards after The Merge. Overall, having an inflation rate below 1% should positively impact the price of ETH, especially if greater utility is added to the mix. In conclusion, the event should result in the following impact on ETH price: More utility + reduced ETH issuance + burning = higher demand → higher ETH price.

What after The Merge?

It could be argued that Ethereum is already lagging behind other PoS blockchains. While none have the Ethereum dApp offering, Solana, Avalanche, Tron and Algorand provide users with Visa-level transaction speeds and negligible fees. With The Merge being completed on September 16, 2022, this means that Ethereum is just starting to approach its performance. Keep in mind that Vitalik Buterin only put 55% upgrade completion after The Merge. More updates will be needed to fully call it ETH 2.0:

1 – The Surge – extending the Ethereum main chain through sharding. This should increase network throughput by up to 100,000 theoretical tps.

2 – The Verge – Upgrading Merkle trees with experimental Verkle trees for greater storage efficiency in each data block.

3 – The Purge – eliminating excess historical data that is no longer needed, so validators can become even more efficient at processing transactions.

4 – The Splurge – the era of maintaining the Ethereum network, tweaking and adding small improvements to the quality of life. In the end, this long roadmap gives Ethereum’s competitors plenty of room to capture DeFi’s market share. Only time will tell if Ethereum’s first move advantage will have this sustaining power.

Warning: The text presented in this column does not necessarily reflect the opinion of CriptoFácil. This is a translation of the content originally published on The Defiant portal. Read also: New preparatory event for The Merge is announced Read also: Avalanche has day and time to reach US$ 22: Friday, until 15:00 UTC Read also: Compound update bug freezes R$ 4.3 billion in cryptocurrencies