Buy the rumor, sell the news. The Ethereum Merge completed without a hitch, but the prices shortly after the launch disappointed investors. I’ll do an analysis here quickly to check the temperature on all the things in the chain.

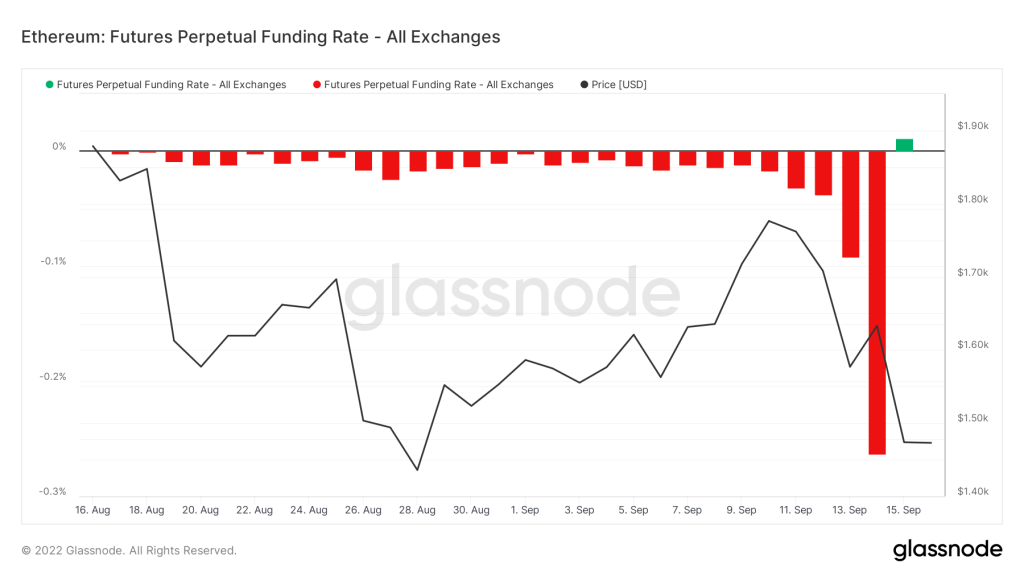

Interest rate turns positive

In the run-up to the Merge, interest rates on Ethereum reached historic lows. It made headlines, but that was to be expected. With Ethereum holders receiving an ETH PoW token, this meant that investors were migrating to long-term ETH and placing short futures orders to receive the token and remove exposure to the price. Given that this was an apparent arbitrage opportunity, the laws of simple market dynamics dictate that the funding rate must fall to reflect the disproportionate number of investors selling ETH futures on the Merge to buy and receive the ETH PoW token. After the Merge, all-time lowest interest rates have now returned to normal levels – and even turned slightly positive. So, no big deal around here, with normal service resumed.

Why did Ethereum crash after the Merge?

As I had my breakfast on Wednesday morning (toast and croissant with honey), Ethereum completed the Merge – at block 15,337,393, to be precise. The ETH price traded around $1,598 and bounced slightly to $1,620, up 1.4%. However, it has pulled back, and as I write this in my breakfast Friday morning (oatmeal and blueberries this time), ETH is trading at $1,470, 8% below the Merge level.

And so, the Merge turned out to be a classic news-selling event. Given that Bitcoin is trading just 2% below the level at which the Merge was completed, there appears to be some underperformance from ETH. Options also hint at bearish sentiment. There was a smile of volatility with a visible bearish divergence in the run-up to ETH. This means that when the strike price was plotted against implied volatility, there was greater implied volatility (above 100%) at lower strike prices – showing that traders were betting on a news selling scenario. Looking at open options by strike price, there were also more puts than buys—meaning that traders were betting on the price going down rather than up.

The Federal Reserve will eventually dictate the price

Of course, all of this will be overshadowed by the important Federal Reserve meeting to be held on September 20-21, when the Fed is expected to announce another substantial rate hike following this week’s disappointing inflation reading. However, it underscores the point that simply because there is a big event going on doesn’t mean the price will go up. It’s an absolutely classic example of a rumor-buying and news-selling event, which we see all the time in the stock market. That said, in terms of Ethereum’s long-term future, the Merge is now in the past and has gone off without a hitch. It is a great achievement and very optimistic for Ethereum in general. Jerome Powell and the economy just need to cooperate now!

eToro

eToro supports cryptocurrency trading in over 180 countries around the world in addition to 48 US states. The platform offers some of the lowest exchange rates and commissions in the industry. Buy ETH with eToro Now Disclaimer

pacific union

Since being founded in 2015, Pacific Union has grown into a world-leading online broker. We offer 200+ products, delivering an innovative trading facility for assets such as forex, indices, commodities, equities and crypto. As a service-focused online trading broker, we provide multilingual services to 120 countries and regions. Buy ETH with Pacific Union Now Disclaimer